If nothing else, 2020 has been a year of accelerated change (and, shockingly, it’s only July). In many ways, it is the year of 2020 hindsight – in which subtle, yet existing trends are thrown into stark relief as a pressing reality accelerates long-term, profound change. Nowhere is this more true than in the global food system, an $8T market that represents 10% of the global economy. In particular, calls for transparency and supply chain integrity have been mounting in the $1.4T meat industry for years, but 2020 brought an urgency. The challenge for founders is to meet this hunger with the right recipe for growth.

We sat down with Kathryn Weinmann and Scott Mitchell to take a closer look at accelerating change in our food system and draw out some lessons that all founders can chew on. Scott is a growth equity investor focused primarily on consumer retail and packaged goods. He recently rejoined Norwest after leading the finance and corporate development teams at Belcampo, an innovative producer and distributor of pasture-raised meat using regenerative agriculture. Kathryn is a venture investor with a focus on consumer companies. She has spent the last 18 months evaluating the future of food, ultimately sourcing Norwest’s investment in UPSIDE Foods, a leader in cellular agriculture.

Let’s start with some basics. Scott, you’re on the growth equity side at Norwest. Kathryn, you’re on the venture side. How do these two differ?

Scott: On the growth equity team at Norwest, we partner primarily with founder-owned, bootstrapped businesses that have historically eschewed venture capital to get started. We are typically providing liquidity or growth capital in the “teenage years” of a business; after it’s found success in the market, but before maturity. Our goal is to help these entrepreneurs successfully navigate the new challenges ahead – such as launching new distribution channels or product categories, taking on new competitors, and hiring an experienced team.

Kathryn: Right – whereas our venture teams have a wider focus. We work with founders in high growth industries at all stages of development; everything from a company’s first seed round, to a late-stage, growth financing. Historically, venture capital often supported an extended period of R&D. Now, it more commonly funds accelerated commercialization and speed-to-scale, which create defensible moats: network effects, cost advantages, IP, and so on. I spend most of my time with founders of Series A and B companies who have found early stages of product-market fit and are looking for a partner to help them scale.

What got you excited about investing in food, and meat in particular?

Kathryn: Well, I’m from Texas, so meat is a big part of my heritage. But as I learned about how meat was brought to the table, I grew concerned about the limitations of conventional meat production. The environmental, animal welfare, and food safety realities are staggering. And global demand continues to grow, particularly in developing countries. The need for alternative sources of meat production creates significant opportunities, both for highly scalable innovation as well as more artisan production. Both of these, together, can protect our food supply.

The need for alternative sources of meat production creates significant opportunities, both for highly scalable innovation as well as more artisan production. Both of these, together, can protect our food supply.

Scott: Definitely. From a consumer standpoint, I’ve always been interested in the health aspect of high-quality meat. I also spent some time at an M&A firm focused exclusively on the food system, and pursued several food companies when I first joined Norwest.

However, I didn’t understand the complexity of the overall system until taking an operating role at Belcampo – a fascinating, vertically-integrated food production business based on regenerative agriculture. I came on board to help the team scale a truly unique company. We operated 50,000 acres of organic ranch land, where we raised cattle, pigs, lamb and poultry, and a 20,000 square foot USDA certified processing facility. We sold that meat through nine company-owned restaurants, as well as a growing e-commerce and grocery business. For context, no other protein company that I know of operates as an integrated producer, processor, distributor and marketer. Most focus on just one aspect. That experience really helped shed some light on just how complicated (and dysfunctional) our food system is.

What’s changed within the food system and food entrepreneurship in 2020?

Scott: Coming into 2020, there were already a number of long-term trends impacting the food system. Because it’s such a large industry, these were playing out over fairly long timelines. So much of what’s occurred in 2020 – from the COVID-19 pandemic, to shelter-in-place, to the necessity for equal opportunity – has taken that slow-turning cargo ship and pushed it 90 degrees in a new direction. We think this presents significant opportunities, and not just in the food space.

So much of what’s occurred in 2020 – from the COVID-19 pandemic, to shelter-in-place, to the necessity for equal opportunity – has taken that slow-turning cargo ship and pushed it 90 degrees in a new direction.

For example, at Belcampo, we served a demand for high-integrity, traceable meat. This demand was already rapidly growing. Many of our customers were knowledgeable about problems in our food system, from the lack of transparency about the source of the product to the inhumane treatment of animals, to concentration in the supply chain. Everything that’s unfolded in 2020 has really just further highlighted those issues.

Kathryn: Without question, 2020 is highlighting the vulnerability of our food system and very much fueling the edible space race. Meat processing is a people-intensive business concentrated in massive facilities. When those groups are infected, the risk expands beyond contagion and into food security, as the price of meat rises and outages (intensified by panic buying) become more common.

2020 is highlighting the vulnerability of our food system and very much fueling the edible space race.

This is particularly true for communities that already struggle to maintain consistent and affordable access to food staples, which is heartbreaking given 30-40% of food in the U.S. is wasted. COVID-19 compounds these issues by disrupting supply chains and prompting large-scale dumping of food staples like egg, milk, and produce. For the past few years, we have had the pleasure of working with Imperfect Foods, which addresses food waste head-on by providing direct to consumer access to produce that might otherwise be thrown out due to cosmetic damage or surplus inventory. To date, they have saved 139M pounds of food!

Let’s talk about transparency. What’s changed in 2020, and what opportunities do these changes present?

Kathryn: More than ever, consumers care about what they eat and where it comes from. We see this happening in other markets too, including fintech, real estate, and consumer products. But the beauty of innovating in an opaque industry is that there is often a huge opportunity to build a trusted relationship with consumers in the blank space left by incumbents. Historically, animal protein hasn’t had to rely as heavily on brand as other categories – shopping lists might include Cheerios (branded), Coca-Cola (branded), a carton of eggs (unbranded), and two chicken breasts (unbranded). For this reason, price has been the most important purchasing criteria for conventional, commodity meat.

The beauty of innovating in an opaque industry is that there is often a huge opportunity to build a trusted relationship with consumers.

But this is changing. We’re seeing that many consumers are willing to pay up for novel meat alternatives (initially plant-based, most notably from Impossible Foods and Beyond Meat). And they want to know what they’re buying. By extension, labelling is a hot topic in food innovation transparency. Many labels displaying bucolic scenes of animal life are deeply misleading. In the case of meat alternatives, there is ongoing discussion about whether the term “meat” can be used at all. But limiting the use of “meat” only to conventional meat risks misleading consumers as well, particularly for cell-based alternatives. For example, if cell-based shellfish were labeled something other than shellfish, that could pose a significant risk to allergic consumers.

Scott: As Kathryn says, people are demanding more transparency from the many companies and institutions they interact with. That transparency is displayed in a number of different and creative ways. For example, multi-vitamin brand Ritual started with the mission to increase visibility in the supplements supply chain and now has an interactive map that displays the original source for each of their ingredients. We’ve also been able to partner with some incredible founders like Kendra Scott and Joe Kudla (of Vuori) who have been aggressively transparent about their values and how those are reflected in their products and brands. That creates a truly authentic experience for the consumer. Increasingly, food consumers are craving this, too.

What about the supply chain? What changes are we seeing there, and what will the effects be?

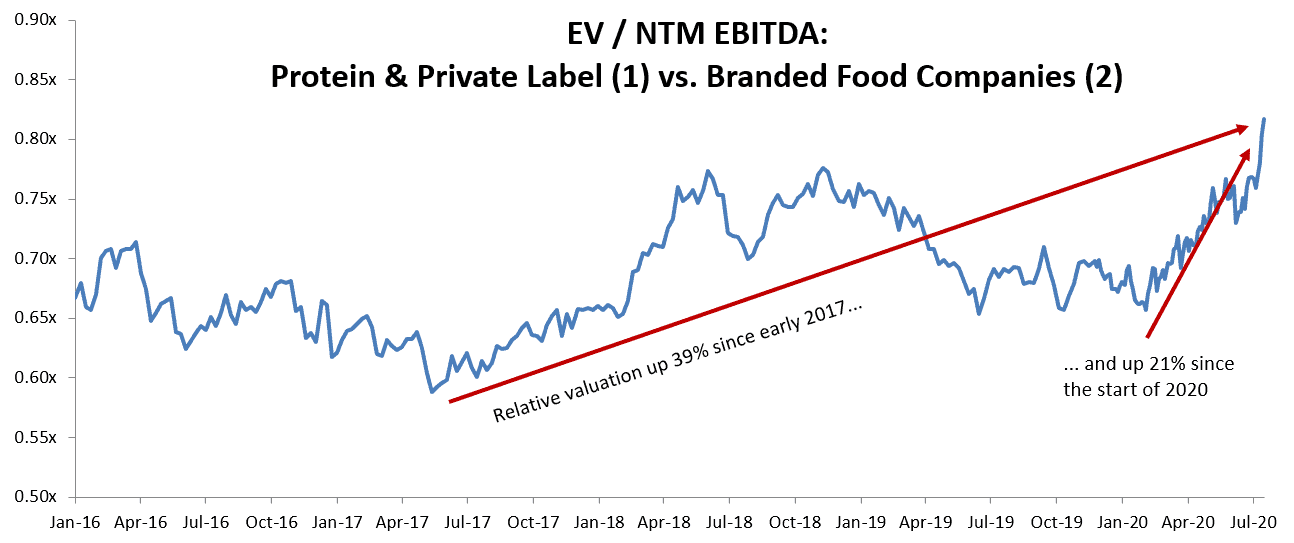

Scott: I actually moved up to the Belcampo ranch when I first started and spent an entire year just trying to figure out how to scale a grass-fed meat operation. That experience really shed light on an industry that is just waiting to be upended. The most obvious indicator is just how concentrated the protein sector is: four companies produce 73% of the beef consumed in the US! The food supply chain is highly regulated, capital intensive, low margin, and is impacted by everything from weather to animal biology. Even though it’s challenging, I do think that companies that either own or are “further up” the supply chain will realize more value for that going forward. In the public markets, we’ve already seen a sharp increase in the relative valuation of protein & private label food companies relative to branded food companies:

1) Index of the following companies, weighted by Enterprise Value: Pilgrims Pride, Sanderson Farms, Tyson, Lamb Weston, Hormel, TreeHouse, JBS, Cal-Maine, Flowers, Smithfield

2) Index of the following companies, weighted by Enterprise Value: B&G, Campbells, Conagra, Simply Good Foods, General Mills, Hershey, JM Smucker, Kellogg, Nestle, Hain, J&J, Modelez, Pepsi

Kathryn: Fundamentally, manufacturers’ efforts to produce more conventional meat in the same amount of space puts pressure on already confined animal conditions, and encourages the widespread use of antibiotics to combat disease. Despite these efforts, meat spoils after only a few days in the refrigerator, due to the amount of bacteria already present before it ever hits store shelves. Further, the majority of known infectious diseases in people can be spread from animals, and three out of four new or emerging infectious diseases in people come from animals. Given this connection, supply chain integrity is critical. Earlier this year, China lost almost half its pig population due to African Swine Flu. China is home to half of all pigs on the planet, so that means that this one outbreak eliminated one out of every four pigs on Earth.

How do these realities impact how companies are financed and built?

Kathryn: For many venture-backed companies in this space, the scientific breakthroughs and innovations required to bring down the cost of production are capital intensive. However, for those able to break through and build that trusted consumer relationship, there can be meaningful defensibility which allows founders to capture the value they create. That’s a big reason why we were particularly excited by cell-based meat: Plant-based meat enjoys an easier path to scale, but brand and distribution are often the central moats. That leads to an expensive and tenuous position for some of the initial disruptors, now facing stiff competition as incumbents produce similar plant-based or blended alternatives (e.g. Tyson’s Raised and Rooted products). Cell-based meat relies more heavily on IP defensibility that it can supplement with distribution and brand advantages. From a product standpoint, we also believe that many consumers don’t want to compromise – they want affordable, real meat that is good for them, animals, and the planet.

Scott: I get excited about supporting entrepreneurs in this space because when there’s an opportunity this large, there’s clearly not a “one size fits all” approach to building or scaling a company. Kathryn’s team is supporting amazing businesses like Memphis Meats that have these incredibly powerful, audacious goals that will clearly take a certain amount of capital to scale. Then you have companies like Vital Farms that are attacking the same problems but offering a different solution. Vital is a pioneer in the pasture-raised proteins space, raised modest amounts of private capital over the years despite having a relatively capital-intensive business, and recently filed an S1 to IPO. These entrepreneurs are offering a product or service to a specific customer and may be better served with a capital partner that can support that more measured approach to growth. Or in the case of Butcher Box, raising no outside capital at all!

In your relationships with founders, what have you learned about how best to approach investment? What features are shared by the success stories?

Kathryn: Good question. Here’s one thing: Start early. Start getting to know investors early, and don’t feel pressure to rush the relationship. I first reached out to Uma, the CEO of Memphis Meats, on March 10, 2019. Almost exactly 10 months later, we wired our investment into Memphis Meats’ Series B. While the actual deal process was only a fraction of that time, the importance of building that trusted relationship cannot be overestimated.

Scott: Couldn’t agree more! Our most successful investments on the growth equity team tend to be in the companies and situations where we felt most aligned going into the investment. From the partnership itself to the growth strategies, to the exit planning. That’s why we really encourage entrepreneurs to start conversations with potential investors before they are thinking about a partner. Not to one-up Kathryn here, but we closed an investment towards the end of last year that was the culmination of a six-year conversation!

Also – find your fit. Do research on the firm’s approach and history to screen out the right fit ahead of time. Then ask those firms to add value in the conversation: get their thoughts on the industry, KPI benchmarks, acquisition opportunities, et cetera. You’ll get a quick sense of whether that firm understands either the industry or specific growth stage your company is in.

Kathryn: Absolutely. Find a mission-aligned investment partner who has the relevant channel expertise to power your go-to-market, and ideally the fund capacity to continue to invest in the company over time. Before investing in Memphis Meats, we met with more than 40 companies in food innovation, as well as incumbents, regulators, investors, and industry groups. That allowed us to understand the opportunities and challenges associated with changing the face of food. We shared with Uma our results from a large consumer survey on consumption habits, shopping preferences, and pathways for exposure to new foods. We discussed brand strategy and go-to-market partners based on our experience working with large brands where consumer education was key, including Imperfect Produce, Talkspace, Ritual, and Wyze.

Also, as a founder, you should have more than just the individual partner on your side – you deserve the weight of the firm you work with thrown behind your efforts. As important as it was for the Memphis Meats team to get to know our deal team, it was equally important that they felt supported by the broader firm.

And what attributes do you look for in foodtech investments specifically?

Kathryn: Foodtech is hard. Consumers rightly have a high threshold for what new foods they are willing to put in their body. Further, this sector is massive and often highly commoditized. So an intense focus on cost structure and ability to defend against both incumbents and other new entrants are key. So I look for founders who have a clear sense of how to build consumer trust, manage their cost structure now and at scale, and intentionally structure defensibility whether through IP or through distribution.

In closing, what is your 10-year prediction for the future of food?

Kathryn: The most successful venture-backed businesses often ride a wave of change as much as they create their own momentum. The way that food is brought to the table ten years from today will be unfathomable to the generations before us. Cell-based meat, alternative dairy, indoor farming, even how we discover and source our food will all change dramatically. Amid all these changes, consumer trust is paramount. Many founders have tried before but were too early; the founders who have the expertise and ambition to wrestle help us cross the (regulatory, quality, consumer acceptance) chasm will be the big winners in the new food economy.

Scott: I hope to see a world where people are closer (physically and emotionally) to how their food is produced. But regardless of whatever specific advancements are made, I do know that this industry will continue to present opportunities for passionate entrepreneurs to create products that improve the wellbeing of our people and planet. If you’re pursuing this mission, I’d love to figure out how we can help!