I had one of those moments of deep existential introspection the other morning. I was spinning on the Peloton, half-watching a Netflix documentary, reading the NYTimes headlines, listening to Spotify (through headphones that I had delivered same-day the day before) while feeding treats to the pup, all in the hopes of getting in a solid workout to garner some Strava “kudos.” As I eked out the last interval, I swapped in the Calm app, took some deep practice breaths and asked myself, “Is this it? Is this really worth it?”

That is: Is the ~$100 a month worth it for my Netflix, Spotify, Amazon Prime, Chewy, Peloton, NYTimes.com, Strava, and Calm app subscriptions?

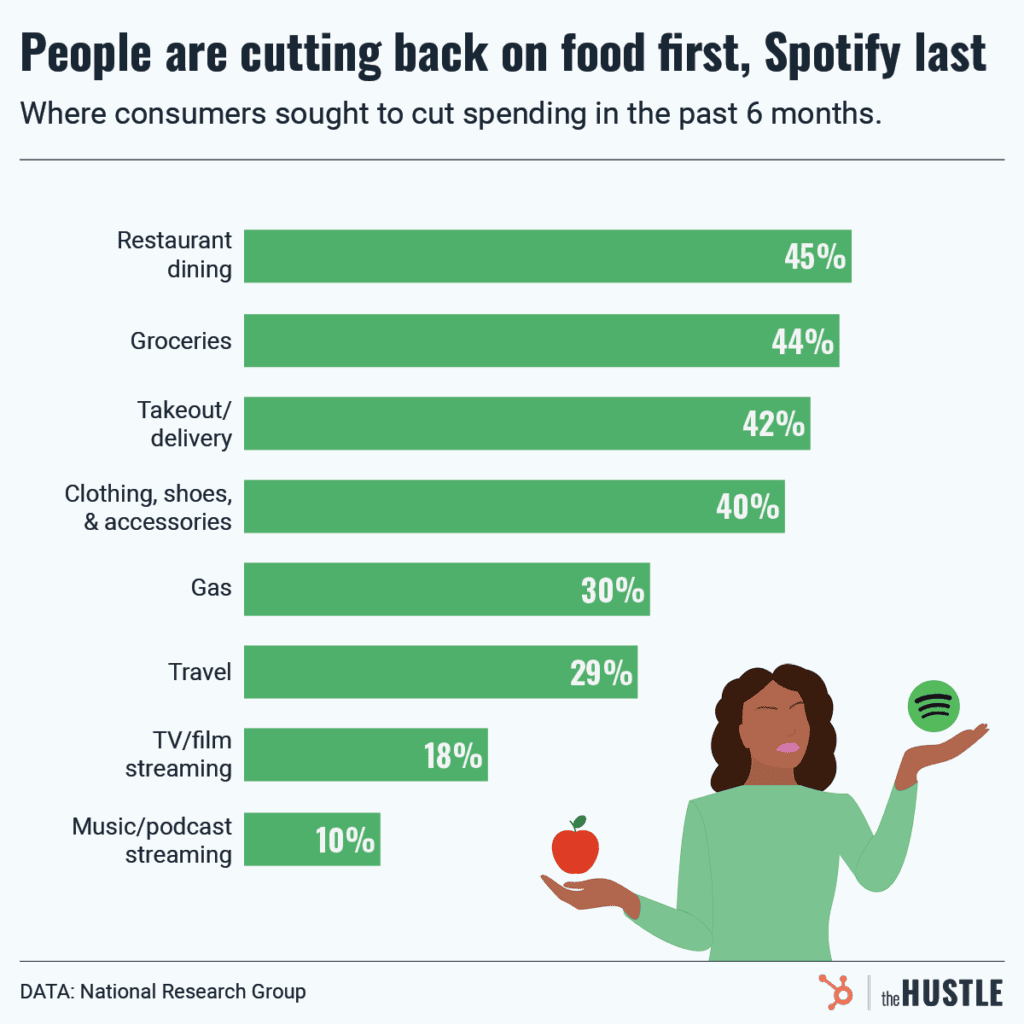

Everything seems to be a subscription these days. Forbes estimates that the global subscription e-commerce market will grow from $73B in 2021 to $904B by 2026. And despite the impending recession, consumer subscriptions are booming. In fact, National Research Group finds Americans are cutting back on restaurants and groceries first and their Netflix and Spotify subscriptions last. So consumers have flipped Maslow’s hierarchy of needs, basically saying – “sure, you can take all my food but I’m not missing the new season of Stranger Things.”

Content creators, e-commerce merchants, and even social media platforms use recurring subscriptions to provide a top user experience for customers – fresh regular content, a personalized experience with immediate instant-gratification perks (e.g., free shipping, unlimited premium access and consumption, no ads). A real win for customers – and upon closer inspection – for the merchants as well.

Butter Eases Churn for New Generation of Subscription-Based Companies

Startups are specifically designed to grow fast, but at some point they need to find a way to actually make money and be profitable. Thus, the name of the game is finding operating leverage. In e-commerce companies – where marketing/acquisition cost is often the largest operating expense – they specifically need to realize marketing leverage.

It’s no secret that customer acquisition costs (CAC) have been skyrocketing in recent years. Although savvy marketers continue to fight and optimize CAC, companies are increasingly focusing on increasing customer lifetime value (LTV) because it’s more in their control. Subscription business models provide a recurring, predictable stream of revenue and – coupled with high margins and retention rates – a healthy LTV. For a new generation of consumer subscription companies, customer retention rate has now become the most important metric in driving strong unit economics and realizing marketing leverage over time.

Customer retention rate has now become the most important metric in driving strong unit economics and realizing marketing leverage over time.

Butter solves a true pain point for these subscription-based businesses (both consumer and self-serve B2B SaaS companies) by recovering up to ~50 percent of unintended subscriber churn. Subscribers can “accidentally churn” for reasons such as:

- card entry typos

- insufficient funds, incorrect card expiration date or zip codes

- overloaded PSPs

- potential fraud

Butter integrates with Payment Service Providers (PSPs) and subscription management platforms to dynamically validate logic, retry, intelligently route, and authorize payments at the optimal moment.

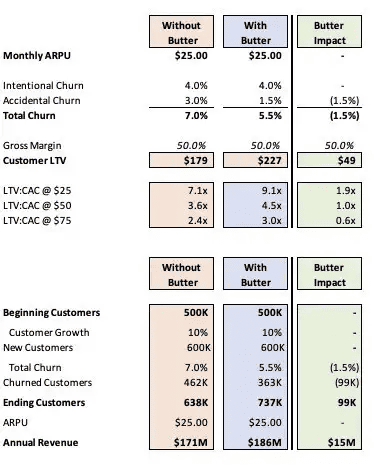

With the compounding nature of subscription businesses over time, Butter drives real and lasting revenue lift to customers immediately. Looking at the example below, Butter reduces accidental churn by 50 percent and improves customer LTV by 27 percent, keeping the LTV/CAC ratio acceptable even as CACs increase by 67 percent. The net effect is a 9 percent lift in annual revenue.

This simple example assumes consistent churn but in most consumer businesses where churn is front-loaded, Butter’s revenue lift can be even higher. And when factoring in the cost of replenishing the subscriber base at higher CACs, Butter’s lift on the bottom line is even more pronounced.

As we navigate a new enterprise environment with falling software budgets, it’s now essential that software companies provide a clear and demonstrable ROI. Butter’s platform immediately drives higher top-line revenue – helping companies grow faster with strong unit economics while becoming (more) profitable.

The Right Leader for a Visionary Company

There’s no one better to drive the Butter vision than founder and CEO Vijay Menon. Vijay has spent the past decade solving payment failure and maximizing subscriber retention for Scribd, Dropbox, and XBox. He understands the product and customer journey as well as anyone in the space. And I’d be remiss if I also didn’t mention that he’s a true renaissance man – a natural serial entrepreneur, an acclaimed TED speaker, and a published author. He not only has strong domain expertise but a unique world perspective – critical skills needed to build a large and successful company with a great culture.

We couldn’t be more excited to have the opportunity to join Vijay, the Butter team and our friends at Atomic on their mission to reinvent the digital payments market!

Editor’s Note: This blog was originally published on Medium.