We’ve gotten in the habit of leaving home without our physical wallets these days. From our daily morning coffee to paying for our kids’ soccer dues, the digital wallets on our phones have become the default payment vehicle for most transactions. COVID-19 only accelerated this behavioral change as both convenience and sanitary concerns came to the forefront (how many people have touched that cash tender or credit card?!). This drove our research into companies providing the underlying payments infrastructure that supports these near-magical experiences to occur and today, we are thrilled to announce our Series C investment in Citcon—the leading payments gateway for digital wallets. We’re joined by a strong syndicate of institutional and strategic investors, including our friends at Cota Capital and Sierra Ventures.

When we first met Chuck Huang (CEO and Founder) and Wei Jiang (President and COO) this summer, we quickly realized that they were uniquely qualified to build Citcon given their prior engineering and product management experiences leading several key emerging products at Visa. Both natives of China, Chuck and Wei saw the opportunity to facilitate payments leveraging the largest digital wallets in the world starting with AliPay and WeChatPay. With Citcon’s single API, any merchant could safely accept payments in-store and online from these wallets. Chinese consumers loved the experience as they could shop with their preferred digital wallets as they traveled around the world. Since then, Citcon has expanded to supporting 100+ wallets and alternative payment platforms around the world, now serving customers based in 8 countries and 30,000+ merchant locations globally.

The World of Mobile Wallets

The ubiquity of mobile wallets is not a new revelation. Mobile wallets emerged as a dominant force within the payments ecosystem within the last several years and continue to gain traction. In 2019, they eclipsed credit cards to become the most widely used form of payment globally. By 2020, there were 2.8 billion mobile wallets in active use. By the end of 2025, the count of mobile wallets is expected to reach 4.8 billion. 1

In the US, mobile-first digital wallets have taken increasing mindshare. The growing popularity of peer-to-peer, buy-now-pay-later platforms, crypto, and neobank wallets—paired with a pandemic-induced shift to contactless payments—has accelerated its adoption for consumers and businesses alike.

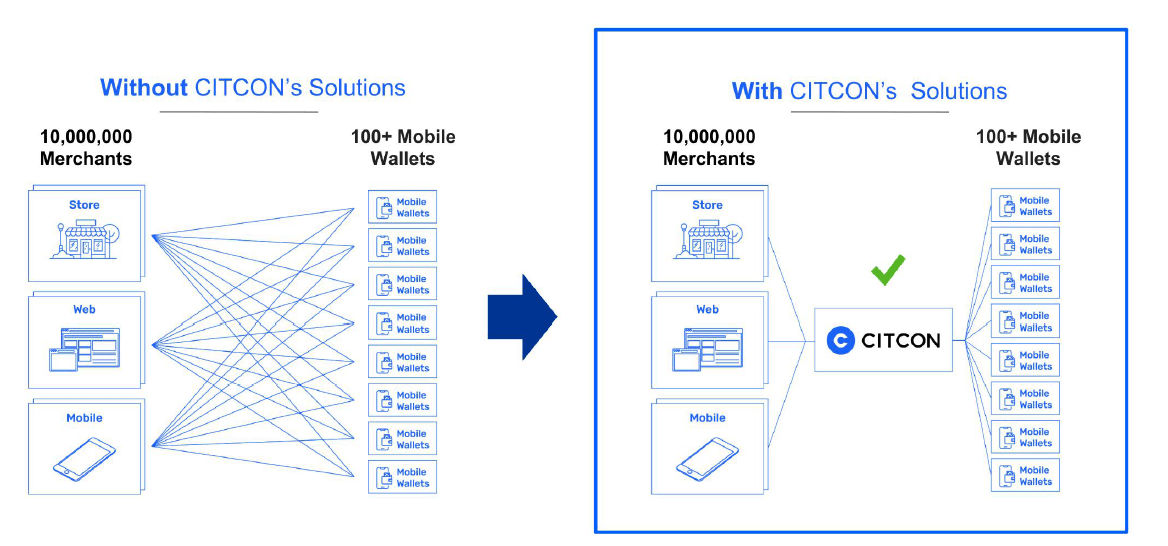

Yet enterprise and SMB merchants are ill-equipped to accept multiple payment elements. Many vendors lack the infrastructure to readily turn on new wallets, and those that do must face the painstaking process of integration: each wallet takes several months to implement and brings its own regulatory, reporting, and compliance requirements.

1 Boku’s “2021 Mobile Wallets Report”

The Case for a Single API

The veteran team at Citcon has tackled this problem head-on, creating one unified API that enables businesses to accept B2C and B2B payments from 100+ mobile wallets, including Venmo, PayPal, AliPay, WeChat Pay, and Klarna. Through one integration with the Citcon gateway, merchants can accept digital payments both in-store and online, broadening the aperture of consumer payment flows, while embedding risk, fraud, and compliance management. In turn, Citcon employs a usage-based model, generating revenue from a percentage of total payment volume.

CITCON has created an elegant solution to an acute and revenue-limiting part of consumer payment flows, both in-store and online

Citcon’s Momentum and Outlook

In building out its network of wallet and merchant partners, Citcon has quickly emerged as a thought leader in the space. Their 3,000+ clients include marquee names across the consumer-facing verticals of e-commerce (Blue Nile), luxury goods (LVMH), QSR (Panda Express), and hospitality (MGM Resorts), as well as B2B enterprises focused on enabling digital payments (Texas Instruments). With the pipes in place, Citcon has seen remarkable growth, facilitating over $1 billion in annualized payment volume, triple where it was last year.

As mobile payments continue to grow in mind and wallet share, Citcon stands to unlock greater value for consumers and businesses alike. Citcon joins other greats in the payments industry and the Norwest family including Plaid, Zenoti, and HoneyBook.

We are excited to partner with Chuck, Wei, and their team of payments veterans, as they help shape the future of digital payments.

To learn more about Citcon’s funding, read “Citcon raises $30M to make paying with mobile wallets ‘as easy as paying with a credit card’” in TechCrunch.