As a twenty-something-year-old, I hover on the border between being a millennial and a Gen Z. I’m old enough to still remember dial-up internet when you couldn’t use the computer and the phone at the same time. How CD players gave way to MP3 players to iPods to iPhones. But I’m young enough that I’d like to think I’m pretty savvy with navigating social media and internet lingo too.

As a venture investor at Norwest, we focus on a wide range of areas including DTC, e-commerce, social, and marketplaces. I’m fortunate to work with investors and board members of companies such as Udemy, Grove Collaborative, Talkspace, and Imperfect Foods, some of which built their marketing strategies around the millennial generation. We even have two partners who helped build social platforms at Facebook and LinkedIn.

Being on the cusp of two generations affords me an interesting perspective of seeing how the two generations intersect and diverge. And while the characteristics, interests, and trends of millennials are well-documented, I wanted to learn more about this emerging generation poised to outstrip millennials in terms of economic power ($34Bn a year and growing). A couple of months’ worth of work later, these efforts culminated in a presentation that features some of the key social trends that can lead to large opportunities for new startups catering to the Gen Z market.

Disclaimer: this trend analysis was created prior to the events of COVID-19, which is why it’s mostly devoid of any mention of the pandemic and its impact. The trends remain prevalent, and several have been accelerated as a result of the new environment.

Who is Gen Z?

Gen Zs were generally born between 1997 – 2010, ranging from 10 – 23 years old. There are slightly more of them in the world compared to millennials (2.5Bn vs 2.4Bn), and they are the first truly digitally native generation. The oldest subset was in middle to high school when Instagram, Snapchat, and TikTok launched. The same group was in elementary school when Facebook, Myspace, and the first iPhone were released. The youngest wasn’t even born yet. As a whole, Gen Zs have considerable spending power at $34Bn per year (mostly from their parents), and this number will only continue to increase as the oldest Gen Zs graduate college and enter the workforce.

In terms of characteristics, Gen Zs share many traits with millennials but exhibit them to a greater degree – hence the nickname “millennials on steroids.”

They are multinational with online friends in different countries. Gen Z are hyper inclusive with a greater percentage of them having friends of different sexual orientations (59% in one survey) and races (81% in the same survey) than any other generation.

They are diverse. In the US, they consist of the most racially and ethnically diverse generation with 48% of Gen Zs being non-Caucasian.

However, Gen Zs differ from millennials in several ways.

They care a lot about individuality and standing out – they care less about branded clothing compared to millennials who generally used brands such as Hollister and Abercrombie & Fitch to blend in, and many of them consider Billie Eilish, with her no makeup, baggy and often eccentric clothes, to be a role model.

Gen Zs are significantly more entrepreneurial too; they are 55% more likely than millennials to want to start businesses and side hustles.

In addition, compared to other generations, they’re the most pessimistic about the world, they feel the loneliest, and they consider themselves to be in the worst health as a generation. However, Gen Zs are also more open with sharing those feelings with their peers too – in what I’ve termed “negative openness.”

What does Gen Z like?

For this Gen Z trend analysis, I decided to focus on social trends because social has increasingly become the connecting thread for other markets such as gaming, entertainment, e-commerce, and wellness. Learning about different trends in the social space and related markets will provide a broader perspective as the next new platform emerges.

The four social-focused trends I’ll be diving into are: digital persona, bite-sized UGC & entertainment, (un)social, and circular consumption.

Trend 1: Digital persona

Observations

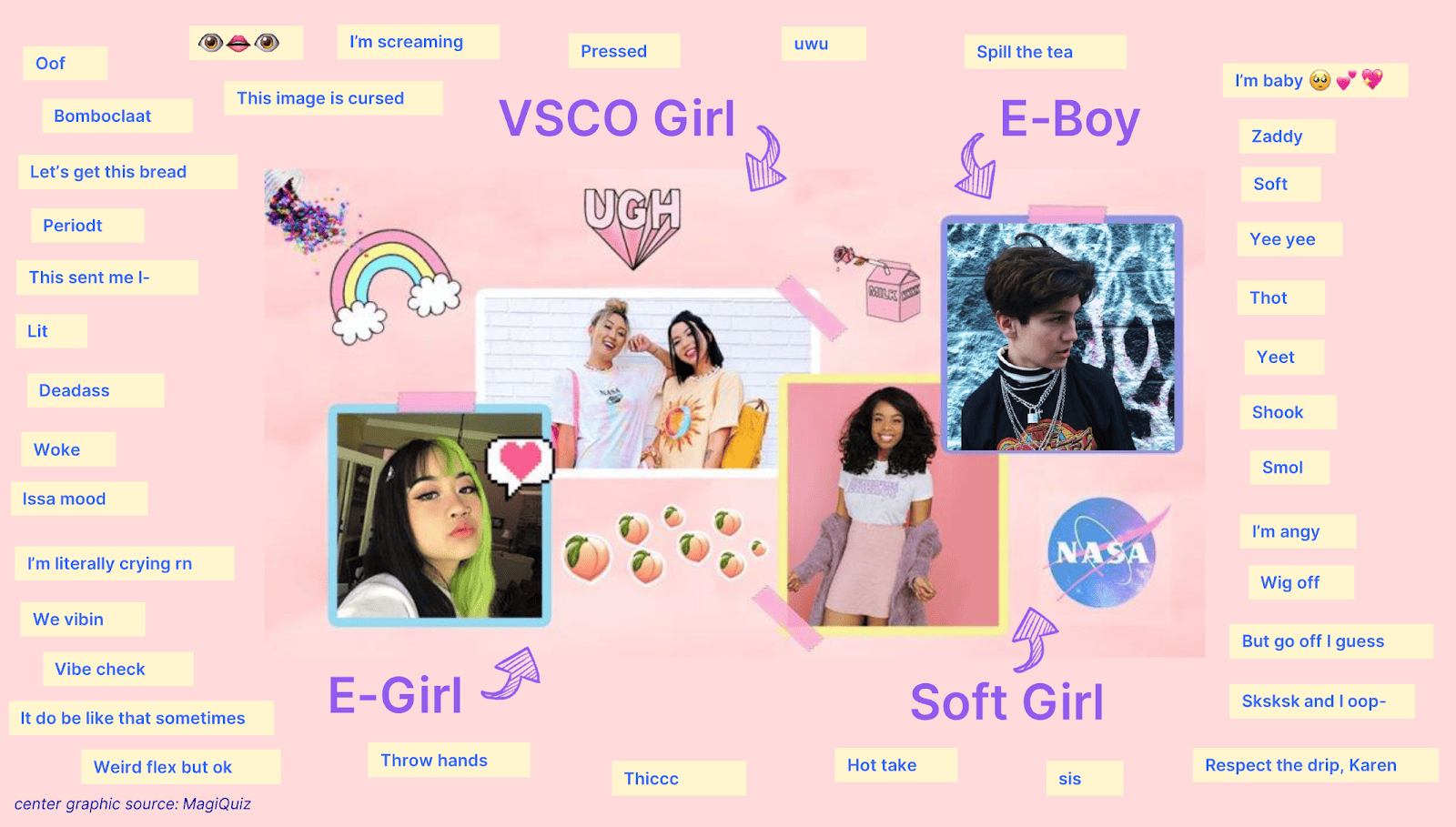

As Gen Zs socialize more via social platforms – shifting through different social contexts with their finstas (fake Instagrams) and online aliases – the lines blur between their online and offline personas. The popularity of Fortnite has normalized socialization within gaming and tightened Gen Z’s identification with their avatars, which has increased their willingness to spend time and money on them.

In addition, CGI influencers are entering the “real” world through both the online and offline worlds. Lil Miquela, a popular virtual influencer with 2M followers on Instagram, has appeared in numerous ad campaigns including one with Bella Hadid for Calvin Klein. Hatsune Miku, a virtual idol with a computer-generated voice, has toured worldwide singing fan-created songs in sold-out venues that real fans attend in-person. The opposite trend is occurring too – Gen Zs are dipping their toes into non-gaming avatars via creation tools such as Facemoji that they share to existing social media platforms.

Opportunities

Gen Z is increasingly spending on virtual goods for their gaming avatars (in-game global spend in 2018 was $93Bn) so there’s opportunity for both brands and gaming platforms to capitalize on this new marketing and distribution channel. Large brands, who are typically slow movers, are already testing out this new channel. LVMH has partnered with League of Legends to introduce custom skins for purchase and KFC released a free dating simulation game through Steam. Marshmello, a popular DJ, held a virtual concert in Fortnite last year that over 10 million players attended.

As a result, gaming is no longer just a content play – it’s becoming a social network, and as Gen Z becomes more comfortable with avatars, the next social/gaming platform may be in the virtual world. AR/VR could be the catalyst here, but there’s a chicken and egg problem as this new hardware platform may also simultaneously need multi-platform support for a breakout game to drive adoption, similar to what Fortnite has enabled.

Despite positive feedback on the tools themselves, avatar creation companies will likely have a hard time given the strong monetization pushback they have seen from their user bases.

One update from COVID-19 is the staggering success of Animal Crossing: New Horizons with many social media accounts popping up to catalog the clothes and items users are creating for themselves and others in the social game. Its popularity highlights this digital persona phenomenon.

Trend 2: Bite-sized UGC & Entertainment

Observations

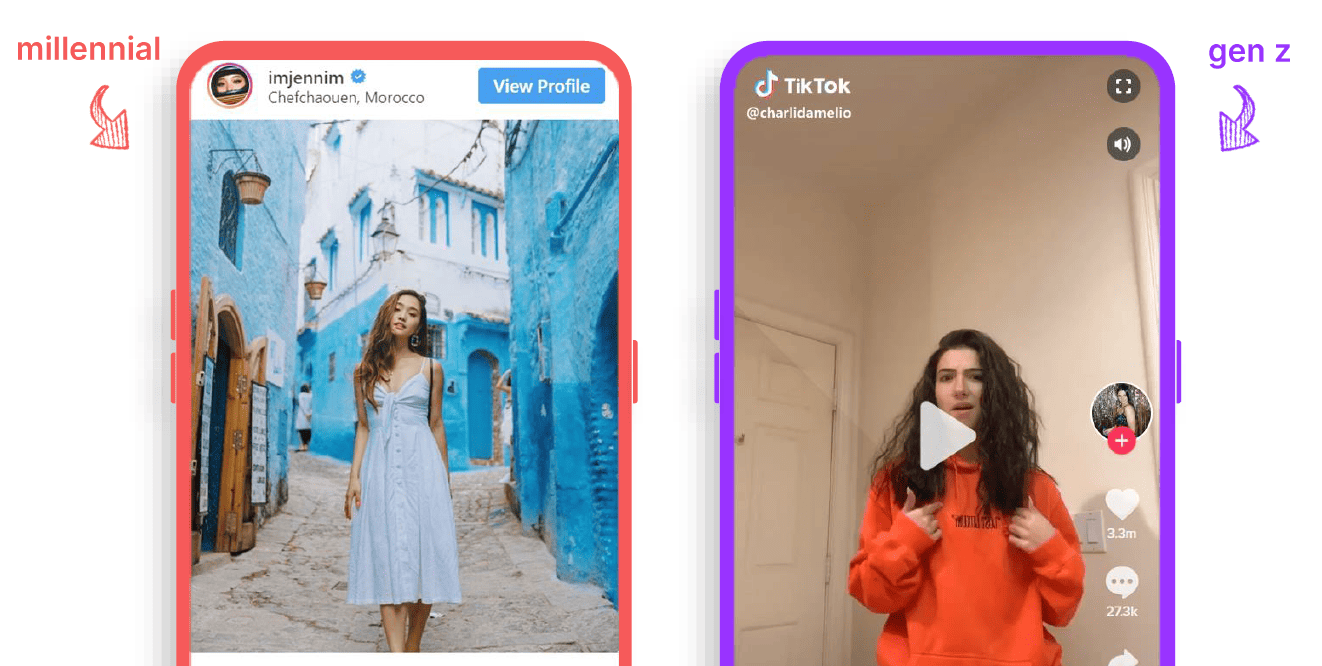

As digital natives who went through the polished phase of YouTube and Instagram content and are now “over it”, Gen Zs now crave realness and relatability with their social media. While the standard millennial aesthetic consists of beautiful locations and highly styled appearances on Instagram, Gen Z aesthetic consists of a less edited appearance framed in a random corner of his or her home.

At the same time, social media and entertainment have increasingly intertwined as this video-first generation both consumes and creates free, bite-sized video content, first through passively consuming YouTube videos and then consuming and creating shorter video stories via Instagram and Snapchat.

As a result, TikTok became popular because it is the amalgamation of all these trends: realness, bite-sized video, and two-way creation and consumption. However, its dominant position isn’t guaranteed.

Opportunities

It’ll be very difficult for a startup to succeed at bite-sized content with high production value since it’ll need to outspend incumbents on content and marketing. In addition, it’ll be challenging to convince Gen Z to pay for content since most of it’s been “free” for them since it’s hosted on platforms that monetize through ads rather than subscriptions. YouTube and TikTok serve as the main entertainment source for Gen Z versus Netflix for millennials.

In contrast, on the UGC side there’s an opportunity for a competitor to rise against TikTok – either via a US-based company that takes advantage of the US concerns around censorship given TikTok’s ownership by China-based ByteDance, or via a company that targets a different demographic, similar to how Kuaishou is gaining market share by focusing on rural (or Tier 3) cities in China.

The driving factors for a company to succeed here are monetization and inclusivity. Convincing popular influencers to migrate to a new platform with better monetization will be key, something that Byte is attempting to accomplish with a rev-share program. However, the content has to be replicable for normal users whether that consists of dance covers or recycled memes so that they feel encouraged to join in. It will be interesting to watch what Byte does given its background with Vine, the defunct short-form video app.

As an adjacent opportunity, short-form social video represents a marketing channel for brands and musicians. Because of the content-driven nature of short-form video versus the identity-driven nature of Instagram and YouTube, there is the ability to appeal to a broader audience. Whereas Instagram and YouTube influencers generally only did sponsorships that closely aligned with their content (or else risk being branded disingenuous), TikTokers have more flexibility.

For example, Charli D’Amelio, a popular TikTok dancer with 40M+ followers, collaborated with Sabra hummus in its first Super Bowl commercial. Similarly, brands are finding success on TikTok through challenges. Chipotle did an ad campaign during the Super Bowl in partnership with Justin Bieber to promote his song “Yummy” and their food delivery services.

Updates: TikTok has hired a Disney+ executive to run TikTok as a means of further distancing itself from its Chinese parent company. Unfortunately, this strategy hasn’t seemed to appease US lawmakers as TikTok is now in talks with Microsoft. Time will tell whether the acquisition succeeds. Kuaishou has also launched its US app called Zynn to compete with TikTok that has seen significant user traction but has been shut down due to allegations of plagiarism.

TikTok became popular because it is the amalgamation of all these trends: realness, bite-sized video, and two-way creation and consumption. However, its dominant position isn’t guaranteed.

Trend 3: (un)social

Observations

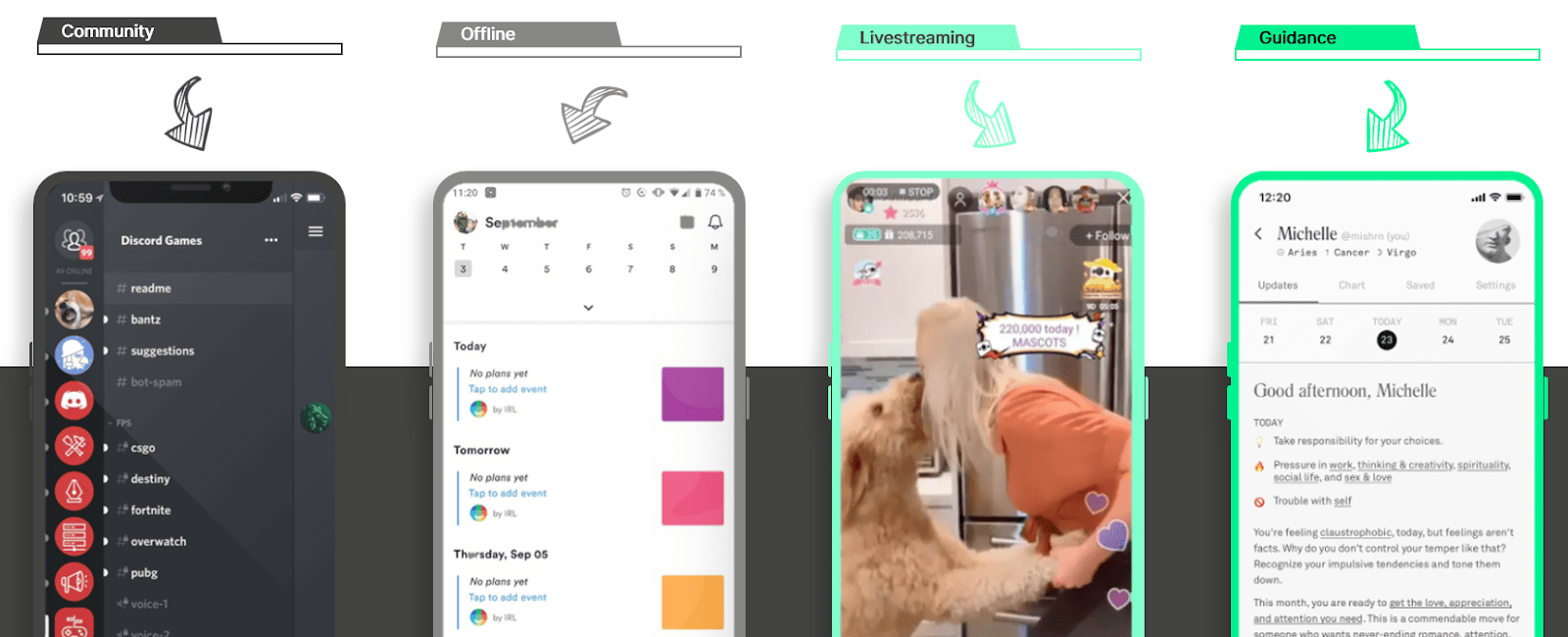

Despite being constantly online, Gen Zs feel increasingly lonely. In a recent survey, Gen Zs scored the highest on the UCLA Loneliness Scale across all generations. In another study, 71% of Gen Zs believed their lives would get more challenging in the future – the highest percentage across generations, once again. As a result, many Gen Zs have turned to consuming longer-form content such as live streaming as one means of ward off loneliness. And in a tumultuous world where religion is on the decline, Gen Zs seek community and guidance through alternative practices including astrology, tarot cards, healing crystals, and meditation. Craving deeper connections with a mindset of inclusivity, Gen Zs are also more open with sharing and talking about their feelings even across traditionally more taboo topics such as mental health.

Opportunities

In terms of content, bite-sized and long-form content will co-exist. Bite-sized content will continue to play a large role in entertaining and highlighting Gen Zs’ best selves whereas long-form, specifically live streaming, will offer more organic, closer-to-IRL conversations.

In terms of companies, many social startups have started to tackle loneliness through different means including live streaming, focusing on community-oriented social relationships, and facilitating offline interactions.

However, it’s unclear whether these companies can become standalone platforms with enough diverse content to drive long-term engagement. Some may become features that are mimicked and absorbed into an existing social platform. The most promising opportunity is in the higher guidance category, such as an astrology-based app with a social angle that connects Gen Zs via shared feelings and deeper intimacy.

Trend 4: Circular consumption

Observations

Commerce and social have intertwined as Gen Zs trust and purchase from influencers via social media. At the same time, they’re constantly online, and with a desire to stand out, they feel pressured to showcase different identities through fashion on social media. Combined with concerns about climate change and an entrepreneurial spirit, Gen Zs turn to and actively participate in secondhand and vintage as the answer.

Opportunities

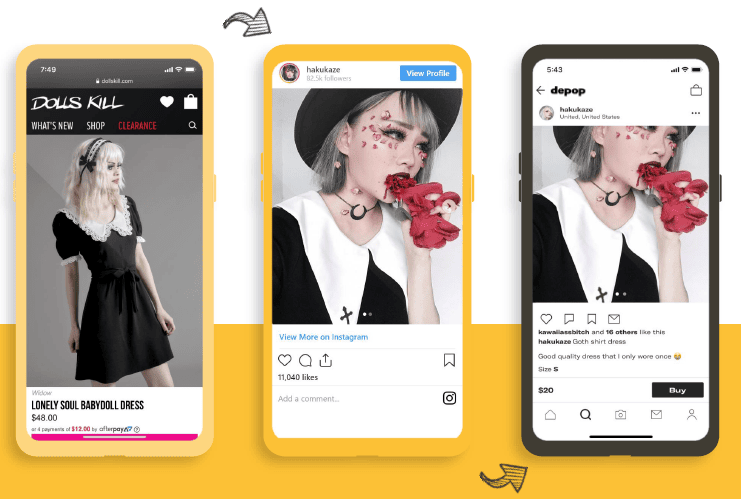

Given the observations, one might think that individuality and secondhand are mutually exclusive, but they aren’t. Gen Zs want to stand out and will look to different types of influencers for creative inspiration while shopping secondhand, prioritizing cost savings and environmental conservation, and allowing them to experiment with new styles. Therefore, there’s opportunity for both aesthetical niche brands such as Dolls Kill and fast fashion brands such as Fashion Nova to fit into a unique online identity that is then commodified to resell clothing.

For example, a unique dress purchased on Dolls Kill can be used with unusual makeup and a wig to create memorable content and spur creativity on Instagram. This identity and aesthetic are then used to re-sell the dress on Depop. Niche brands help build and elevate the online persona, and these influencers can mitigate inventory and monetary investment by reselling.

Gen Zs are already used to trusting influencers and peers with recommendations and given their willingness to start side hustles, they’re turning to each other for clothing inspiration. Therefore, a Gen Z-focused, peer-to-peer apparel marketplace that focuses on creativity and self-identity will succeed. We’ve seen curation by companies, but this will be curation by peers. (Curation of secondhand fashion by companies is hard to scale, after all.)

What does the future of social look like?

There are many markets in which Gen Z-focused companies can offer a fresh approach. I believe there will be a true Gen Z-targeted social platform that emerges with the components and trends outlined above. A Gen Z professional network may also emerge alongside innovations in the social space. Given how entrepreneurial Gen Zs are, new peer-to-peer marketplaces will arise. Based on how unhappy they are, there may even be a new wellness practice or “religion.” Brands that can leverage these new marketing and distribution channels will succeed.

The space is still nascent, but this is meant to serve as a framework for evaluating new opportunities that arise when these companies do start to solidify. For founders creating companies serving Gen Zs, I’d love to chat – feel free to drop me an email at mnie@nvp.com (maybe a Gen Z company will revamp email).