I know. The overall economic outlook isn’t exactly rosy right now. The market shocks are very real, and companies and management teams are working through a lot of disruption. Companies with liquidity issues are just trying to make payroll and anyone tied into global supply chains is scrambling; it’s a good time to be working with bits, and a bad time to be working with atoms.

However, it seems like the general economic pessimism has bled into areas where it may not belong. For example, I’ve been told there’s a sentiment that the world of growth equity has gone into a sudden freeze. Entrepreneurs and founders with whom Norwest has had solid long-term relationships are saying to us: “boy I wish I had done a deal before COVID-19 hit . . . you guys were right about de-risking a bit in a bull market.” The assumption is that, now it has hit, they’ve missed their window.

On the flip side, founders from our most recent investments are relieved, glad that they partnered with us just before the pandemic hit. They feel good about having de-risked, strengthened their balance sheets, and gained liquidity.

The truth is: No-one has missed the boat. It’s not too late. Growth equity is alive and well, there is plenty of capital to invest. We are open for business.

It’s understandable that people would think the current disruptions have put the brakes on growth equity. It is a form of investment, all investment occurs on a balance of risk and reward, and instability brings risk. In private markets, the repercussions can be slower than in the public market, so people sometimes take a wait-and-see strategy. Unpredictability makes purse strings tighten.

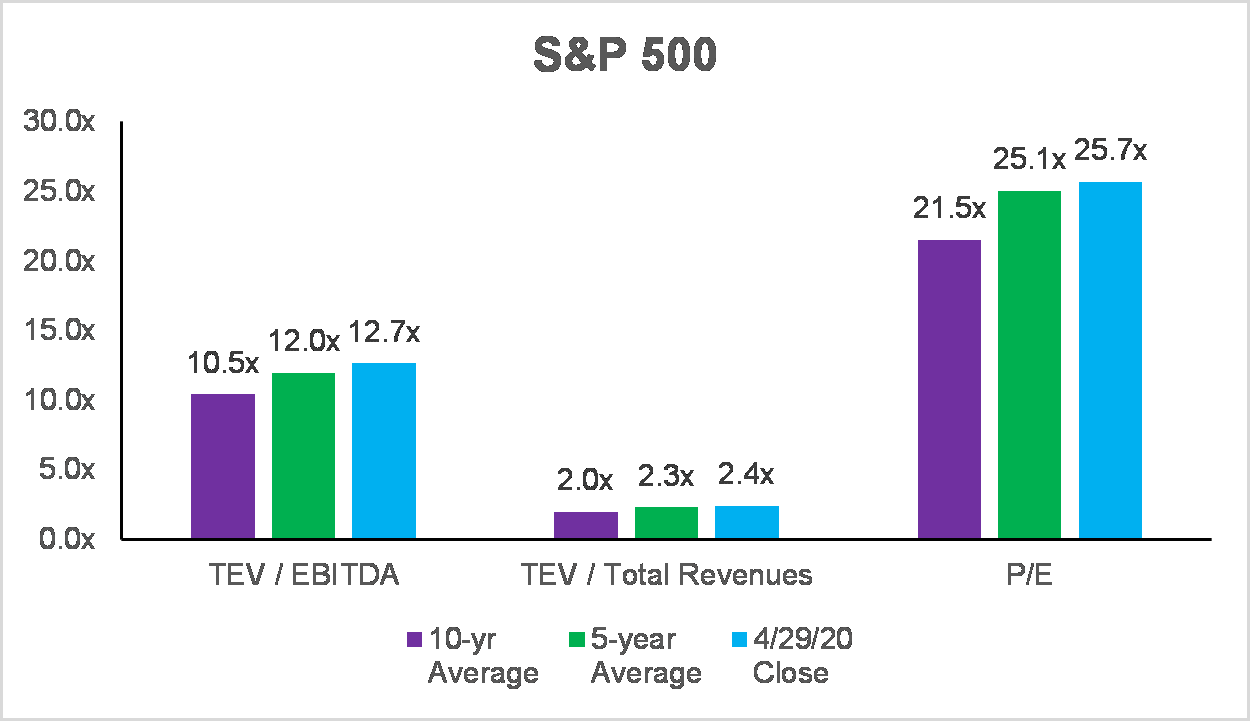

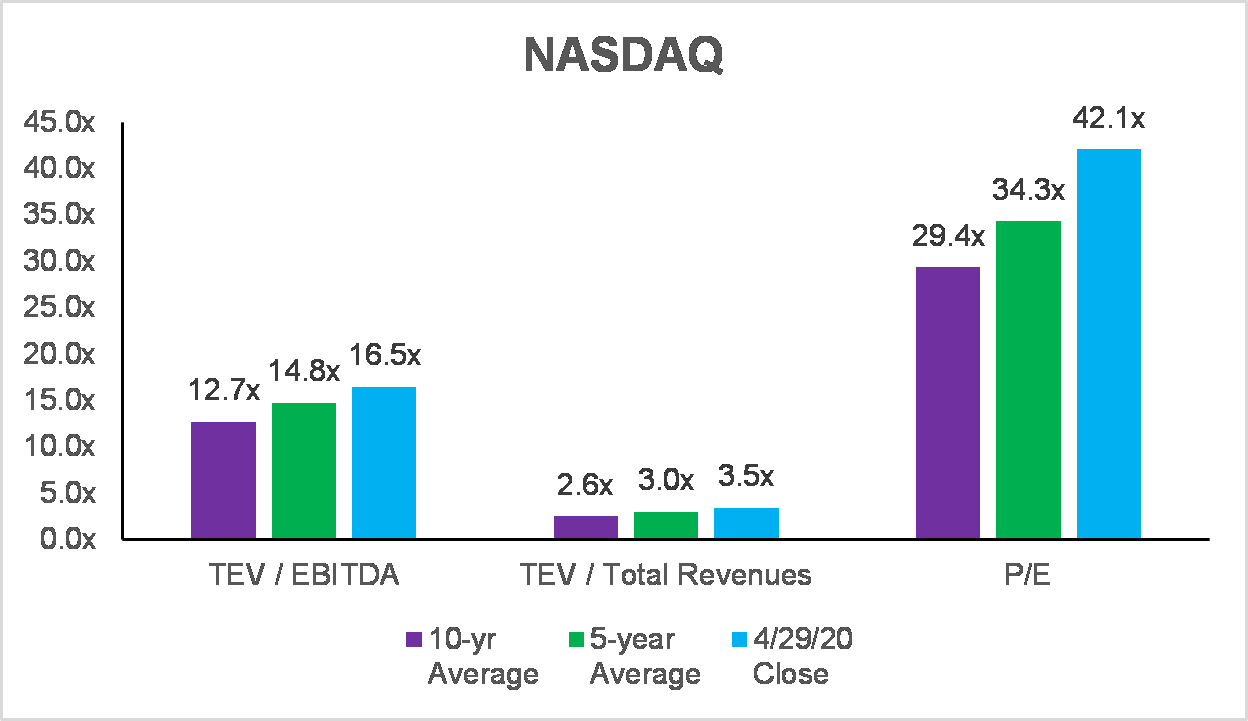

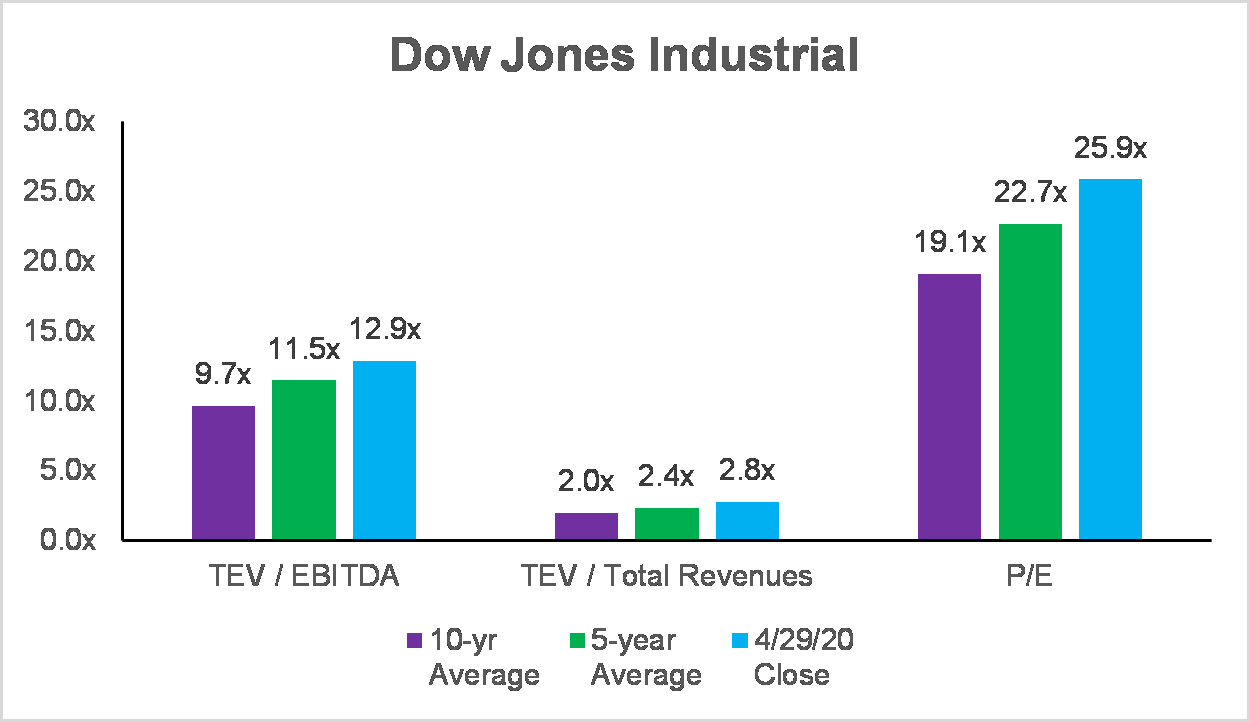

Sure, valuations are not at their peak. But they are still strong. The charts below show multiples for the major indices, as of April 29, 2020, trading at premiums compared to 10-year and 5-year averages. It is well known that multiples peaked earlier this year in February, but the data over the last ten years shows that it wasn’t until mid-2019 that multiples began to consistently trade at levels surpassing where we are today.

This crisis is different from the global financial crisis, 9/11, and dot-com bust; this time it’s temporary, and the snap-back could be powerful. We have already witnessed this in some of the trading days where markets have rallied. Growth equity isn’t venture capital. We’re dealing with mature companies who have proven themselves. They may well have ridden out previous storms. The current crisis will end; when it does, investors will want to have placed their bets smartly while everyone else was panicking.

These are unprecedented times. But partnering with a growth equity firm during a downturn or a recovery confers a lot of benefits:

- It remains a powerful way to personally de-risk, acquire liquidity, diversify, and strengthen your balance sheet.

- If you do a minority deal, the valuation difference from a peak market could be negligible, to the point that it shouldn’t impact any decision.

- There might be good tax motivations; you might need to net out stock losses, for example.

- You’ll gain a partner with a war chest who can help drive opportunistic acquisitions; a real bonus at a time like this.

- If things do get worse, you have a partner to help shoulder the burden.

- When things do get better, you’ll have a head start, and be able to use fresh capital to clean up your product, train your people, make new hires and upgrade processes.

I know this is a strange and unsettling time. But all of this is temporary. A downturn and a recovery can be uniquely powerful moments to bring in growth equity.