Report

Software Consolidators: What 430+ Transactions Can Teach Us About M&A

Most M&A deals will fail to generate enough value: Studies cited in the Harvard Business Review point to a failure rate of 70-90% on M&A transactions. Yet a subset of companies, broadly classified as “software consolidators,” have been able to consistently unlock value through M&A across hundreds of deals. Roughly defined, software consolidators are businesses where the primary driver of growth is based on acquisitions, or whose enterprise value has consistently been boosted by a steady stream of software M&A.

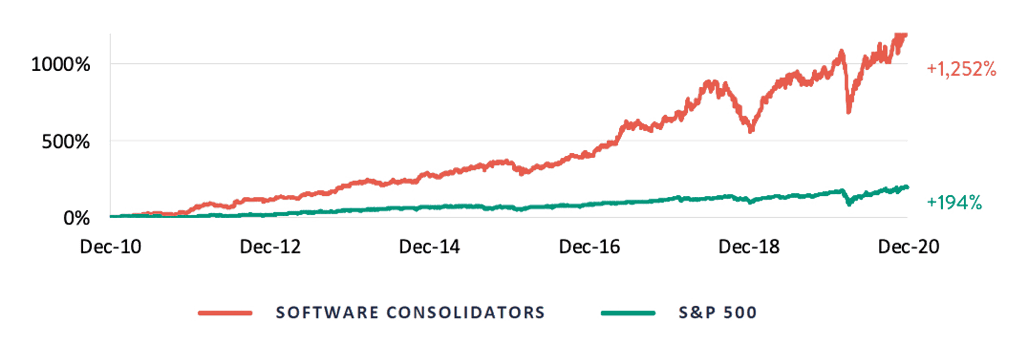

While other software consolidators are sure to exist, we focused our research on a US/CAD publicly traded cohort consisting of Asure Software, Constellation Software, Descartes Systems, OpenText, Tyler Technologies, and Upland Software to glean success factors. Since December 2010, an equal-weighted index consisting of these companies has increased approximately 13x in the public markets compared to roughly a 2x gain for the S&P 500. Over the same time period, this group of companies has collectively announced more than 430 acquisitions.

SUMMARY

Shared M&A best

practices (from deal origination to

post-close integration) from the world’s top software consolidators

SHARE:

Notable Software M&A Best Practices Uncovered

While there is no clear model to emulate, these companies tend to employ variations of a few common themes that have been integral to their success:

1

Focused Target Screening & Criteria

2

Broad Deal Origination & Nurturing Capabilities

3

Extreme

Valuation Discipline

4

Standardized

In-house Due Diligence

5

Streamlined Integration And Post Closing

Common Themes That Have Allowed Software Consolidators to Consistently Unlock Value via M&A:

1

Focused Target Screening & Criteria

Underpinning the success of software consolidators is the clearly defined framework they apply when screening potential acquisitions candidates to maintain a clear inclusive/exclusive criteria. Constellation Software, for example, clearly sets out its acquisition criteria on its website. While each company takes a nuanced approach to M&A, there are a handful of striking commonalities across the general profile of acquisition targets:

Median Deal Size Is <$20m

The most apparent characteristic of the acquisition targets is their size – most deals range from $5 million to $20 million, with a few larger ones of over $100 million, but none that we would consider transformational in nature. Often, these are long-standing, founder-owned software businesses. Pursuing many small deals instead of relying on episodic “big-bang” transactions has allowed these companies to take a programmatic approach to M&A. Moreover, deals that are sub $20 million in value tend to attract less interest and competition from other parties, namely private equity, which results in discounted valuation terms.

Vertically Focused & Mission Critical

Typically, targets hold strong positions in niche, vertical markets, which helps limit competition. The end-markets are rarely high growth or rapidly evolving, and can generally be characterized as consistent, stable and even mundane. We also observed that software consolidators target businesses with over ten customers to avoid concentration, but under tens of thousands of customers to avoid competing with well-capitalized, horizontal software providers. Targets often provide mission critical software solutions that address specific pain points of that industry, resulting in low customer attrition, recurring revenue streams, and high potential switching costs. We haven’t seen many instances where software consolidators undertake the risk of improving a low retention business as they’re typically acquiring targets that already offer an incredibly sticky product.

Modest Top-line Growth & Profitable

From a financial profile standpoint, software consolidators look at businesses that are breakeven or profitable and exhibit modest top-line growth (typically flat / slightly declining, through low teens historical growth at the high end), which is reflective of their stable market positions. While these businesses possess solid fundamental capabilities and have shown capital efficiency, the acquirer has typically identified an inefficiency that can be remediated post-close (e.g. sales motion, pricing, profitability, etc.)

2

Broad Deal Origination & Nurturing Capabilities

Software consolidators utilize internal deal origination teams to build a large “top-of-the-funnel.” These teams are solely responsible for uncovering, building, and maintaining relationships with acquisition targets. This devotion to origination and the ongoing development of relationships with potential sellers results in a continuing stream of proprietary deal flow and stands in stark contrast to serial acquirers in other industries who mostly pursue opportunities through “broad auctions” or via intermediaries like investment bankers and advisors.

Most software consolidator acquisitions grow out of long-term relationships the origination team has maintained with the potential seller, which can stretch back decades in some cases. The benefit to playing the long game is twofold. First, companies can create proprietary deal flow and get differentiated assets at attractive valuations, a massive advantage in today’s competitive deal market. The second, less obvious benefit, of starting engagement early is to develop a deep understanding of the target’s capabilities and potential fit within the organization so the acquirer can have strong conviction on the opportunity and hit the ground running for an eventual deal. Edward J. Ryan, the CEO of Descartes, attributed the company’s continued M&A activity during the COVID-19 pandemic to the “businesses we’ve known for a long time and owners that we know personally. There’s nothing stopping us from getting those deals done.”

One element that should not be overlooked in the deal origination process is the ability of software consolidators to draw targets to them by building a corporate reputation of being “preferred acquirers.” Through ongoing dialogues with potential sellers, software consolidators take an active effort in marketing themselves as a safe landing place for founders, employees, and customers. Sellers value the “buy-and-hold forever” philosophy where they can enjoy the financial backing and expertise of a large company while maintaining their independence and autonomy.

"We're good at going in and convincing small-business owners that we're the best home for their baby, and we see that nothing's changed really in that market."

EDWARD J. RYAN

CEO of Descartes

3

Extreme Valuation Discipline

The most important driver of success for software consolidators has been their ability to acquire businesses at low multiples relative to what their business trades at. Factors contributing to low acquisition multiples include target size, proprietary deal processes, lack of viable exit alternatives as niche players, and the “preferred acquirer” status of the consolidators.

Software consolidators bring this rigorous approach and discipline to valuation to every single deal (regardless of size) as deal multiples seldom deviate from the norm. Upland and Tyler have publicly cited target adjusted EBITDA acquisition multiple ranges of 5-8x and 6-7x, respectively. Similarly, OpenText looks to acquire businesses at revenue multiples between 2-3x. Even as the consolidators have scaled (five of the six are now multi-billion-dollar businesses), we observed no material shift in acquisition multiples. When contrasting that with high-performance conglomerates (HPCs), who eventually drifted towards paying higher multiple for larger acquisitions as their businesses scaled, it becomes evident why software consolidators have continued to outperform the S&P 500 meaningfully while HPCs have reverted to the mean.

2.5x Revenue / 6.6x

Adj. EBITDA

Median Acquisition

Multiples for Software

Consolidators

6.6x Revenue / 34.9x

Adj. EBITDA

Median Software

Consolidator Trading

Multiples as of 12/15/2020

4

Standardized In-house Due Diligence

Software consolidators conduct an efficient and cost-effective due diligence process that reduces post-close risks and ultimately sets the deal up for success. They utilize in-house personnel to run the diligence process, rarely hiring external counsel, financial advisors, or consultants unless the deal is outside their scope of expertise (geography, market, etc.) This vertically integrated approach to diligence allows them to save costs, move quickly to close (many tout a 10-20 day closing timeline), and identify post-closing liabilities and risks.

Phases of the Diligence Process

The initial stages of diligence are predominantly focused on understanding the value proposition and mission criticality of the product as software consolidators require conviction on attrition, recurring revenue, and switching costs prior to moving forward with a potential transaction.

Conservative approach to modeling synergies and focus on cost-reductions through redundant resourcing primarily in the G&A and R&D functional areas. Skeptical lens to cross-sell and other revenue synergy opportunities with the exception of price optimization opportunities.

If an opportunity fails to meet the clearly established hurdle rate in the financial modeling stage of diligence (typically mid-to-high-teens), consolidators are quick to end the process but are transparent with the target in a way that allows them to maintain the relationship and potentially revisit a transaction down the line.

5

Streamlined Integration and Post Closing

Each of the companies we studied employ similar well-defined M&A integration and post-closing processes. They all start with a clear transition from diligence to integration planning, which features the appointment of an “integration manager” or GM that had been involved in diligence. In addition to having a deep knowledge of the market, the integration manager possesses a thorough understanding of the acquisition strategy, model assumptions, as is ultimately held accountable for the unit’s ability to achieve operating targets. The integration manager has frequent access to the consolidator’s CFO, who is typically a very strong leader tasked with executing multiple deals simultaneously and monitoring performance post-close.

Consolidators apply a metrics-based but decentralized approach to managing acquisitions, which allows for efficient scaling even as the number of acquisitions under the umbrella increase. Most acquirers allow these units to be run in an independent manner with limited “hands-on” oversight so long as the integration / operating plan (and corresponding financial targets) are being met.

Select Items on Integration Checklist

1. Centralize IT, accounting, and CRM onto the same shared system to streamline reporting

2. Identify and eliminate redundant costs

3. Manage customer communications during the transition to minimize churn

4. Update pricing and sales sheets

How Norwest Can Aid Your Software M&A Efforts:

Each component of the “Software Consolidator” playbook is straightforward in concept, but difficult to execute in practice given the level of rigor and resources involved. As a leading investment firm focused on growing software businesses, we have helped successfully execute software M&A best practices across a number of our portfolio companies, including multiple sourced and executed acquisitions at our portfolio companies Cority, Galvanize, Infutor and Avetta over the past 5 years, with the average equityholder return on acquisition exceeding 3x in a short timeframe.

AREAS WHERE WE’VE HELPED

MANAGEMENT TEAMS INCLUDE:

Screening / Deal

Origination

Our team of 15+ professionals act as a “corporate development arm” for our portfolio companies, and speak to over 10,000 businesses every year – with many ending up on our portfolio company acquisition pipelines

Transaction Due

Diligence & Execution

We have ~$10Bn under management and have invested in over 500 companies since inception. We have tremendous transaction experience spanning due diligence, deal structuring, debt capital raising, financial modeling, and negotiations

Integration

Our senior advisors have personally overseen countless successful M&A transactions and integration projects, and often guide our portfolio companies on maximizing value post-close

Recruiting &

Talent

We have a strong network of operationally focused CFOs with M&A experience and 60 years of experience gauging scalability of founders and management teams

As you consider scaling your business, we would be happy to connect to share how M&A can be leveraged to accelerate growth and how Norwest can serve as a value-added partner.

NORWEST CONTRIBUTORS

Ran Ding

PARTNER