At Norwest, we believe that some of the biggest disruptions of the next generation will occur within our food systems – both in terms of what we eat and how it gets to the plate. Many of these changes have massive potential to expand food access and drive sustainability within this massive industry. Our teams have been actively investing in this space for a while now, across alt-protein (Upside Foods, formerly Memphis Meats), consumer packaged goods (Kishlay Foods, MTN OPS), and food-focused marketplaces (Imperfect Foods, Swiggy).

Our guest, Jo Zhu, a student at Stanford’s Graduate School of Business, shares our passion for this future. Jo spent 10 weeks with us focused on the many changes occurring in the space. In this three-part series, she shares how COVID has accelerated a number of key trends, insights on emerging business models, and a breakdown of the core technologies unlocking sustainability levers for the next generation.

This is part 1 of our Future of Food Blog series. You can also explore part 2 and part 3 of the series in the coming weeks. Here, we dive deeper into the cataclysmic impact of COVID and how these trends will continue to impact the food sector.

Introduction

Up until this point, my personal (and now professional) focus has been to identify my role in helping our food systems – albeit at a macro level through my time as a Product Manager at both Uber and DoorDash. As we emerge from the pandemic, It seemed apropos to focus on the food industry. Suppliers, distributors, and other food-related tech startups are a fixture in everyday life even as lockdowns come to a close.

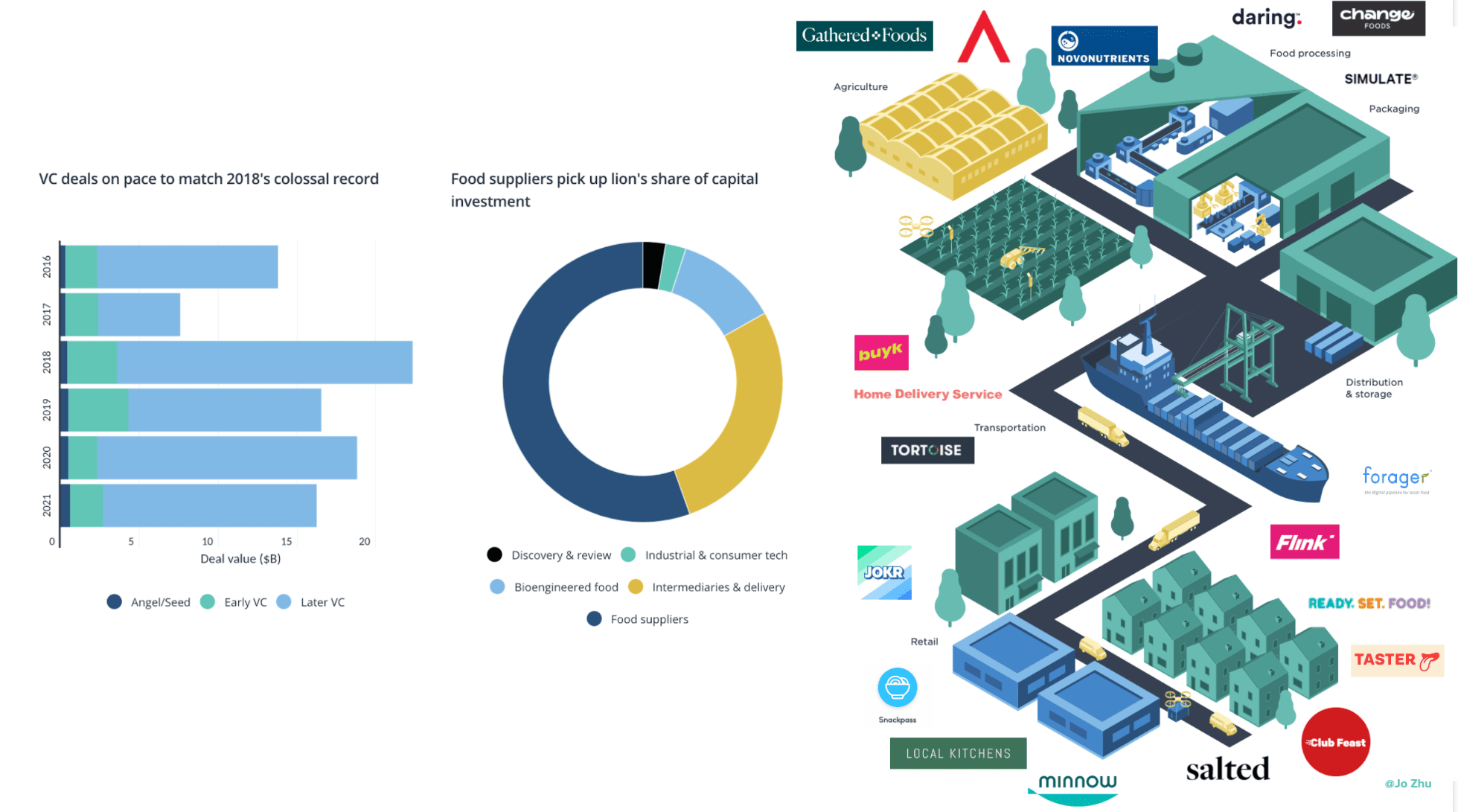

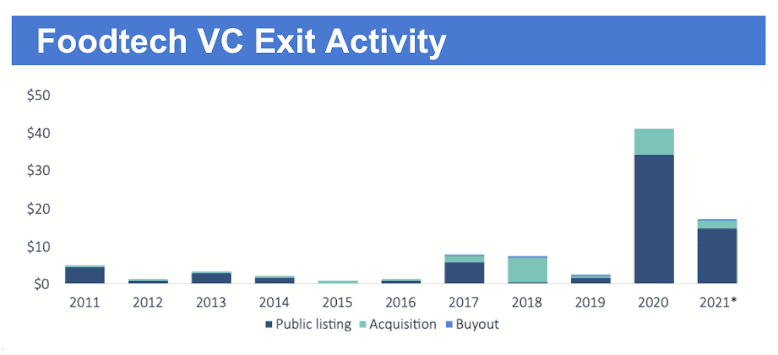

Source: FoodHack

While tech-related investment into the food industry has traditionally flown beneath the radar, new technologies and mobile capabilities have sparked interest in the space. As of 2021, the global food market contributed $11.7 trillion in revenue and is expected to grow at a compound annual growth rate of 5% from 2020 to 2027. In the first 6 months of H1 2021, food-related tech startups have raised more than $16 billion across 586 deals, 86% of the total raised in 2020!

Expanding Data Reach

In recent years, food system data capture points have dramatically improved and are gathered in real time. This spans across preference data captured through cookies, digitized food ingredients and nutritional information, and consumer and industrial equipment that can harvest vast quantities of production and distribution data.

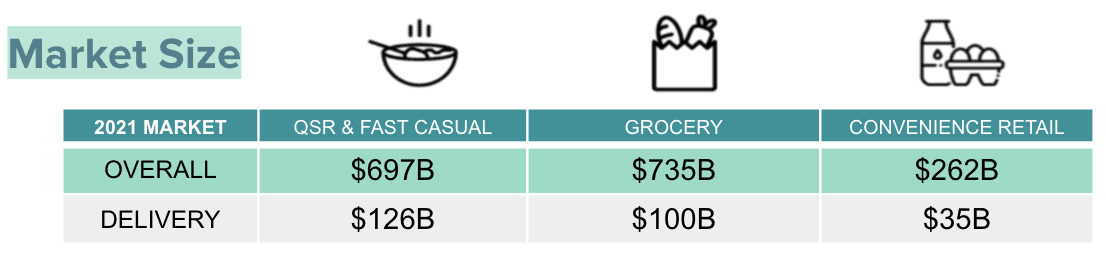

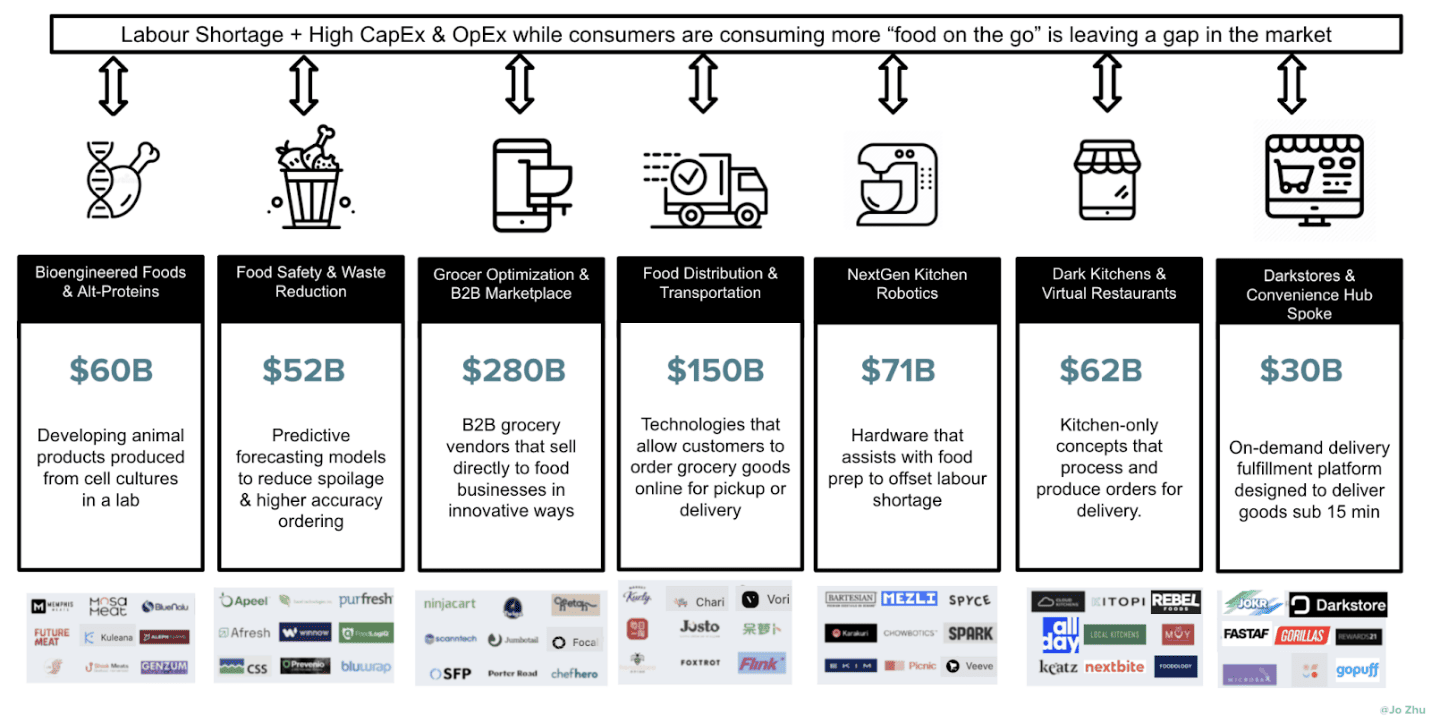

These new data capabilities have set the groundwork for a new generation of foodtech companies that tap into food system data sources to build products for a growing list of use cases, including demand prediction, food waste reduction in production facilities, and consumer discovery. When we look at the total TAM, this market can generally be segmented into three buckets:

- Food Service: Sales of prepared foods from restaurants, cafeterias, commercial kitchens, and other providers

- Grocery Goods: Sales of goods available at grocery stores, such as packaged foods, produce, and drinks

- Convenience Retail: Quick service food & grocery in a corner shop or bodega with smaller SKU count

What has changed in this industry post COVID19?

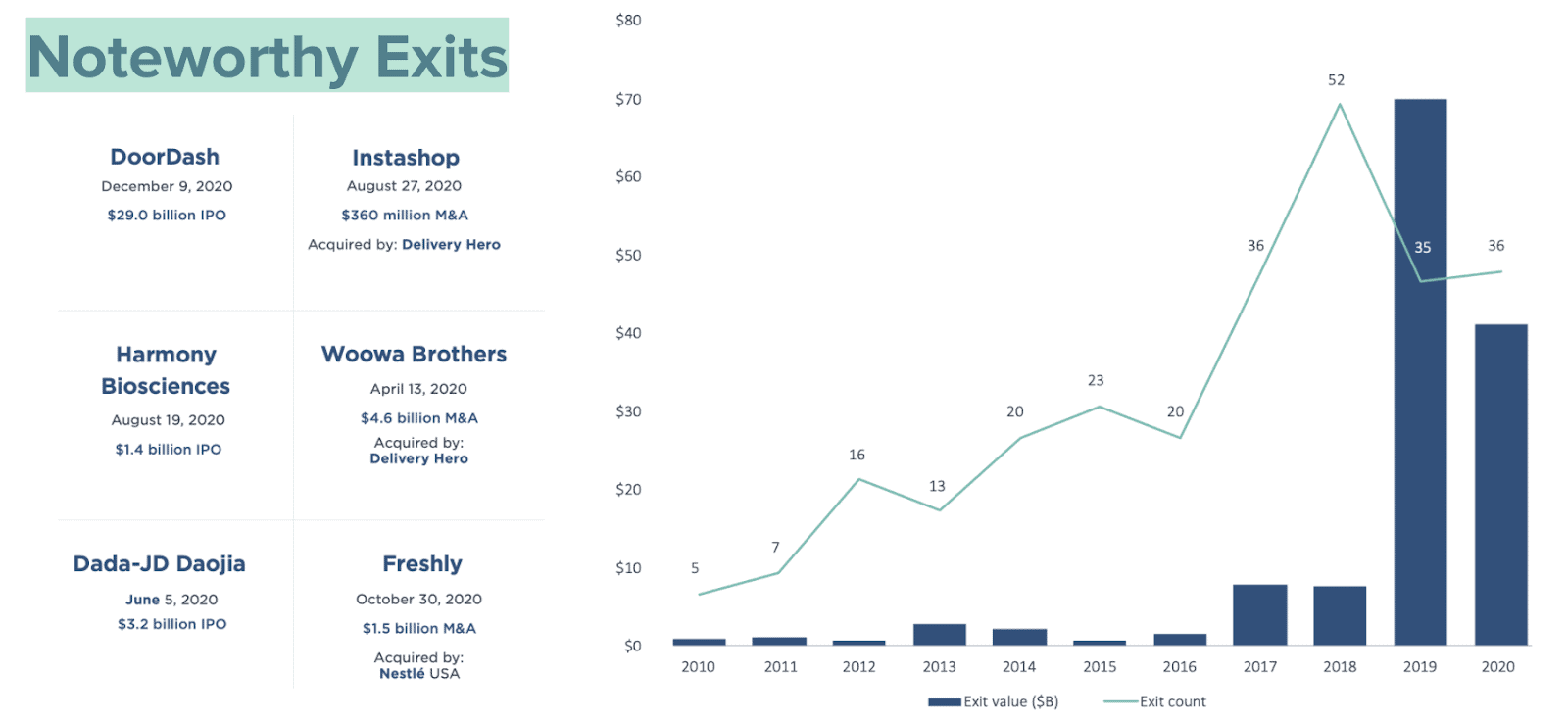

This growth is driven by increased online grocery options such as meal kits and online grocers, and pandemic-led heightened demand. These growth drivers have led to an influx of investment and exits such as DoorDash, Harmony Sciences, Freshly, and Instashop.

Source: FutureFoodFinance

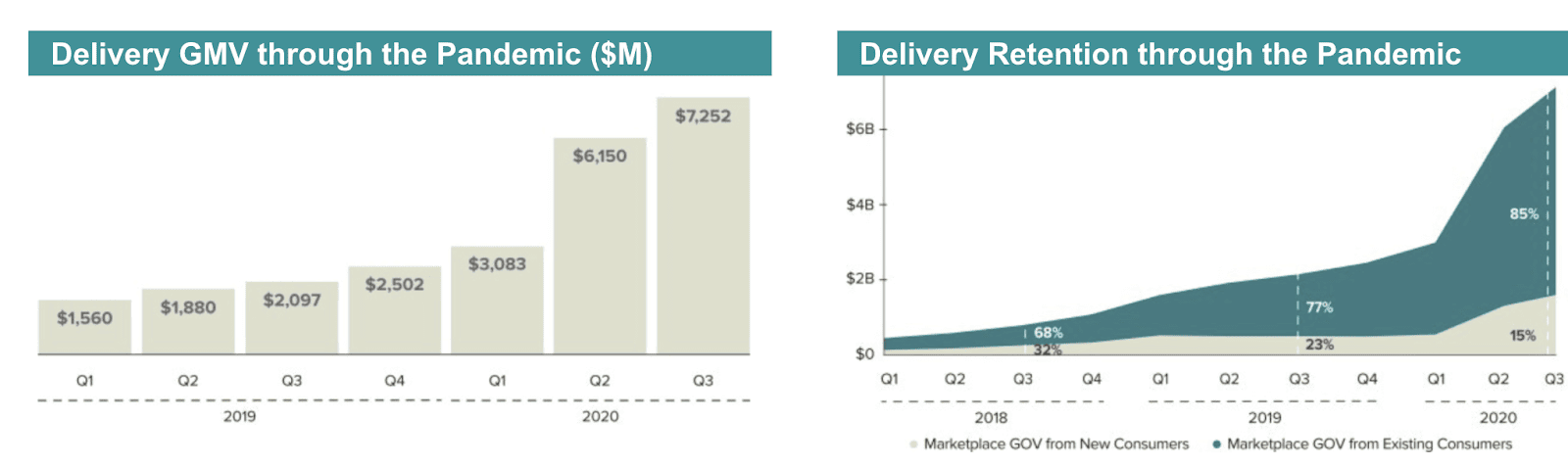

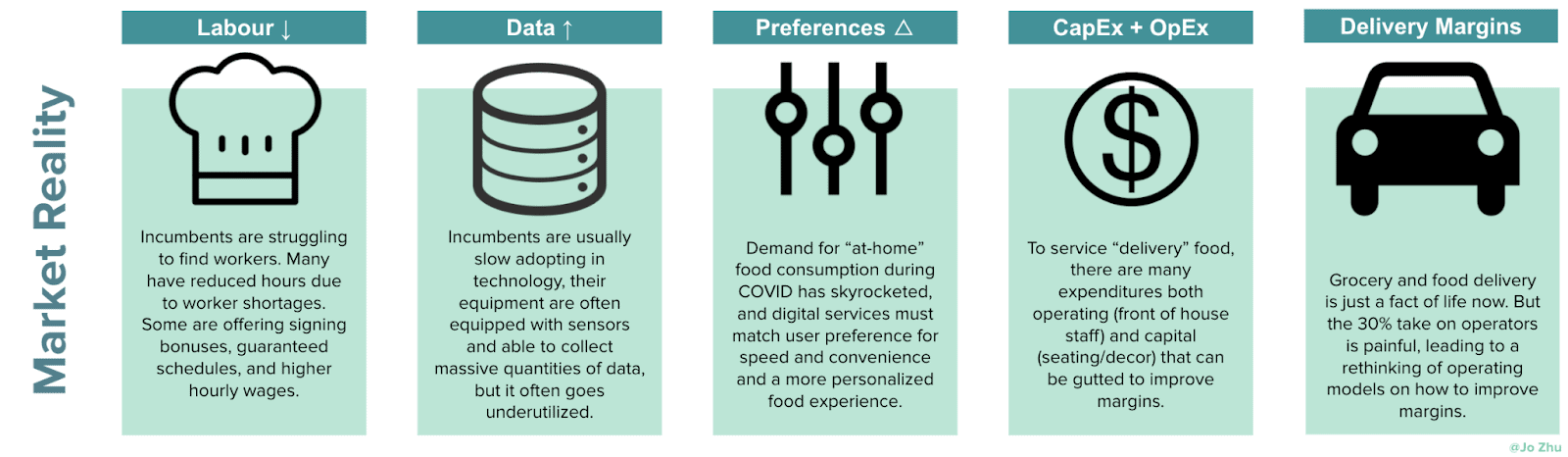

And in the course of the pandemic, fundamental marketplace levers have changed:

- GMV across the board rose as basket sizes increase at both grocery stores (through hoarding purchases) and food establishments through delivery

- Churn has dramatically reduced as consumers and businesses depend on their digital providers and offerings not as a nice a to have but as a core capability

- And this is also leading to LTV:CAC improvements, leading many investors to believe in the long-term structural growth opportunity of these sectors as food businesses are generally slower to implement new consumer-oriented technologies relative to other sectors.

Source: DoorDash S1

What is driving the growth in 2021?

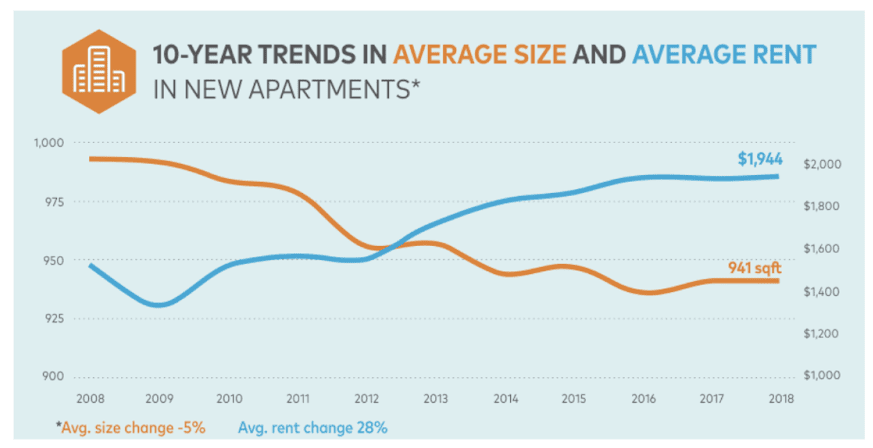

- Home confinement leads to a spike in demand: Although the pandemic is temporary, the expectation is that many consumers will continue purchasing through this channel. Also in the last decade, the average size of new apartments in the US—kitchens included—has decreased by 9.7%. This trend of shrinking kitchens reflects US consumers’ ebbing interest in gourmet cooking and concurrent heightened dependence on restaurant dining, food delivery, and prepackaged meals as their primary food sources.

Source: Globest

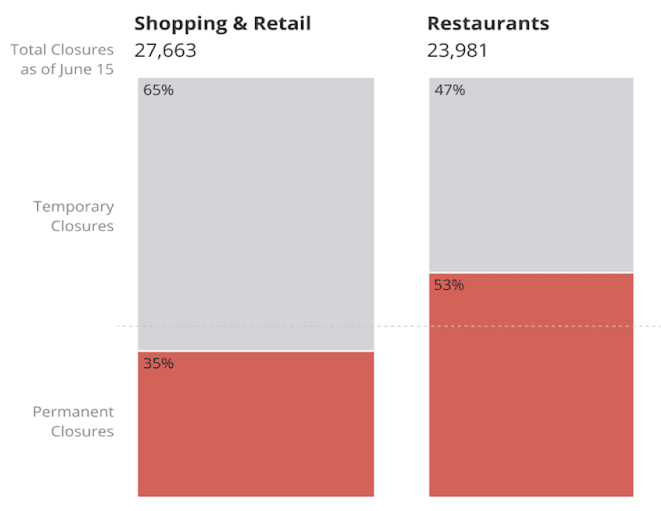

- Shock to the system: Similar to how many other industries (eg. education, manufacturing, etc.) are holistically rethinking their operating model through the pandemic, COVID-19 has upended the food industry, as 17% (roughly 110,000) of US restaurants have permanently closed since the pandemic started. Of the ones who stay in business, they will need to invest heavily into their respective tech-stacks and reevaluate the infrastructure that supports their day-to-day operating model.

Source: CNBC

- Increasing investment by public behemoths like Amazon and Walmart, but also new players with an arsenal of capital: DoorDash, UberEats, Rappi, GoPuff, MercadoLibre, Meituan, Grab are making investments across the food value chain by extracting better consumer preferences, streamlining data synthesis, perfecting sourcing processes, and holistically increasing the selection and convenience of food. These companies are building the infrastructure that are inspiring a new generation of food startups that can reach consumers faster given the speed to which they can latch onto the growth engines of these behemoths.

Source: FutureFoodFinance

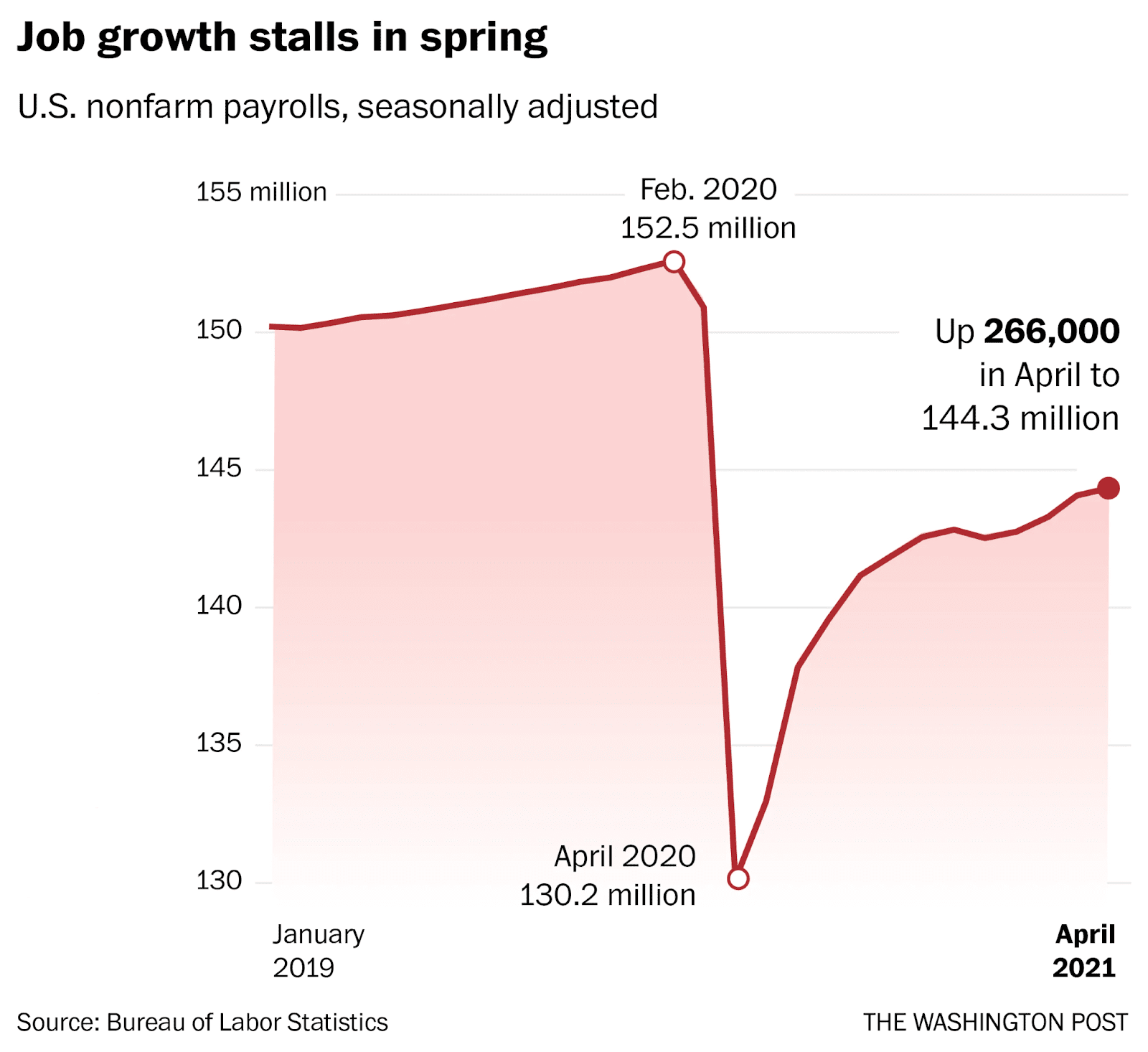

- Labor shortage and razor-thin margins: The COVID-19 pandemic has had lasting effects on the food industry, from production to supply chain to delivery. Labor shortages are one of the biggest issues the industry faces, as restaurants struggle to replace workers laid off during the pandemic. Restaurants like McDonald’s and Chipotle are raising wages and offering bonuses to attract more workers. Traditionally, labor shortages and high churn in the food industry have been significant drags on margins, helping drive the need for kitchen automation technology.

Source: CNBC

What are the opportunities in this sector?

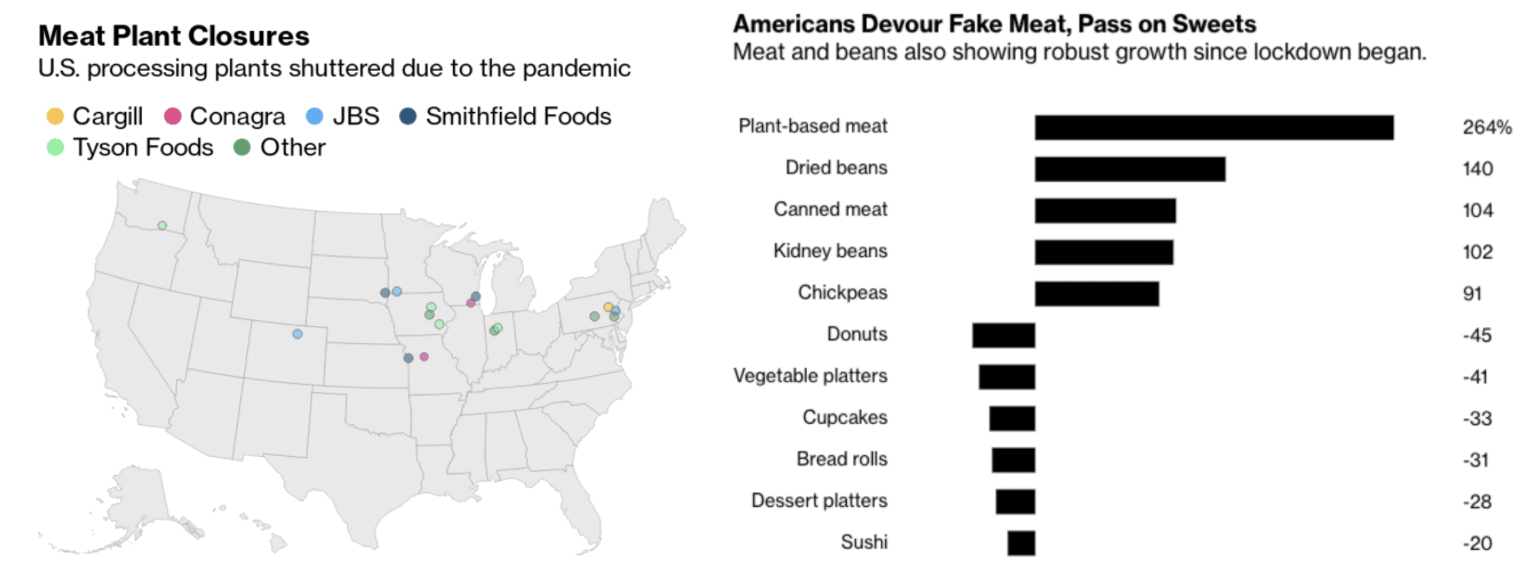

- A future where protein isn’t dominated by conventional meat sources

- At the moment, meat is still king. By some estimates, 30% of the calories consumed globally by humans come from meat products, including beef, chicken, and pork. During the onset of COVID-19, the meat industry was slammed by warnings of meat shortages due to shuttered plants, resulting price increases, and growing numbers of sick workers — conditions that would potentially present new opportunities for plant-based companies.

- As an estimate, the livestock sector requires a significant amount of natural resources and is responsible for about 14.5% of total anthropogenic greenhouse gas emissions.

- From fermented proteins to cultured proteins to microalgae, going forward, the meat value chain could be simplified dramatically, as cultivated meat production facilities could take the place of farms, feedlots, and slaughterhouses.

Source: CNN

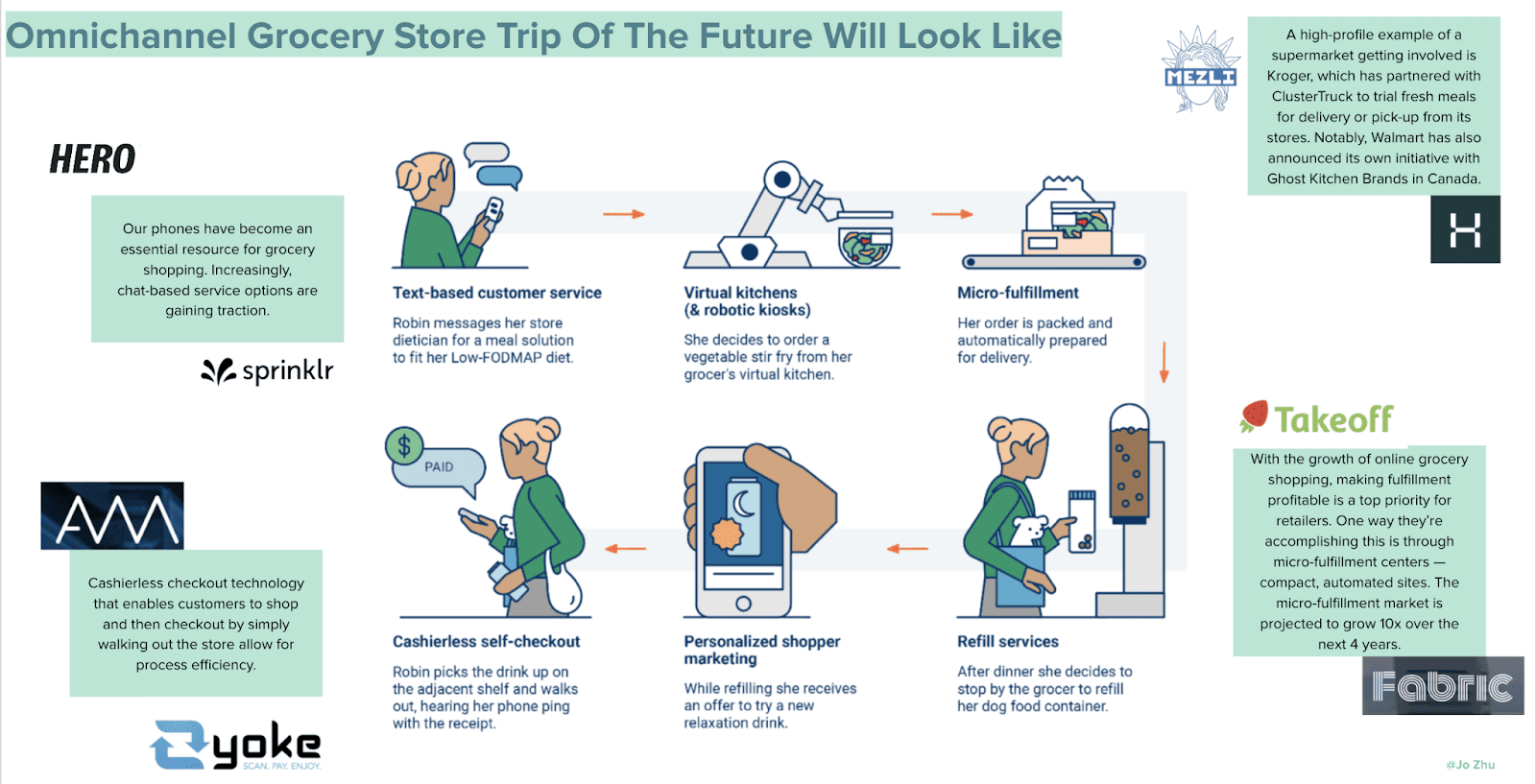

- Grocery stores of the future & darkstores

- Social distancing is driving many consumers to order both food and groceries from home, many for the first time. Aside from ramping up fulfillment capabilities, grocery stores are implementing technologies that enable contactless interactions that are faster than traditional methods while helping ensure social distancing.

- One way incumbent grocers are responding to increased delivery demand is by creating local distribution centers, or “dark stores,” to fulfill online orders.

- Food delivery can be half the current price point if labor and rent are augmented

- A Salad doesn’t have to be $15. It turns out that a lot of that high price point comes down to costs that are passed down to customers. An average Sweetgreen restaurant costs $2.4M to build and runs up a $600K/yr bill for on-site labor. That all gets passed on to customers so that a $15 salad bowl has only about $3 worth of ingredients in it, but also $3 of restaurant labor and $9 to cover things like rent and profit margin. A new generation of robotics-assisted D2C Delivery virtual brands are bringing the cost of that meal sub $5.

In closing

Physical goods industries, such as the food business, are generally slower to implement new consumer-oriented technologies relative to other sectors – it’s a huge market and in 2021, there is the right combo of technical innovation and external forces driving the disruption of legacy models. For this reason, I believe food tech represents a large and growing market opportunity.

The space is still nascent, but this is meant to serve as a framework for evaluating new opportunities that arise when these companies do start to solidify. For founders creating companies in the food tech space, we would love to chat! Feel free to drop us an email at jozhu@stanford.edu or at kfw@nvp.com.