Adopting the right strategies and policies for integrating environmental, social, and governance (ESG) considerations is a growing focus for executive leaders today as they seek to differentiate their companies across a competitive landscape and amidst shifting societal expectations. That’s why many CEOs and founders in Norwest’s portfolio are asking for guidance on how to design, implement, and measure ESG programs in service to building future-proof companies.

To provide guidance on this topic, Norwest hosted a webinar to introduce portfolio companies to the “G” in ESG—corporate governance. Given the headwinds brought on by the current macroeconomic environment, we believe that strong governance practices will put companies in the best position to survive and thrive during what could be a prolonged downturn. At the same time, good governance can help companies avoid reputational risks that could threaten otherwise healthy corporate performance and brand equity.

It seems that few can articulate what good governance looks like, but almost everyone understands the pain of poor governance (think of the headlines you’ve seen over the past few years, especially in recent weeks!). We hope the education provided here can help our companies, and the broader ecosystem, to understand the pillars of governance and the levers available to the collective “we” to lead with purpose and affect positive change.

To dig into this meaty topic, we invited our senior ESG advisor, Shu Dar Yao, to share her insights on corporate governance. As the founder and managing partner of Lucid Capitalism, a boutique ESG and impact investing advisory practice, Shu Dar works closely with Norwest and its portfolio companies to educate and guide them on climate change, social inequality, and related risks and opportunities.

Founders and CEOs from Norwest portfolio companies joined the conversation, posing many insightful questions.

Following are highlights and key takeaways from the discussion.

What is Corporate Governance?

Governance is the foundation of effective ESG work, and success in basic business functions more broadly. It is the rules, roles, and processes by which a company and its board are run. It answers questions such as:

-

-

- Who has decision-making authority and who exercises it?

- What positive behaviors does leadership demonstrate?

- Are the right policies in place before they are needed?

- How do everyday decisions align with the company’s purpose?

- Can employees freely speak up and feel heard?

-

Governance Starts From the Top

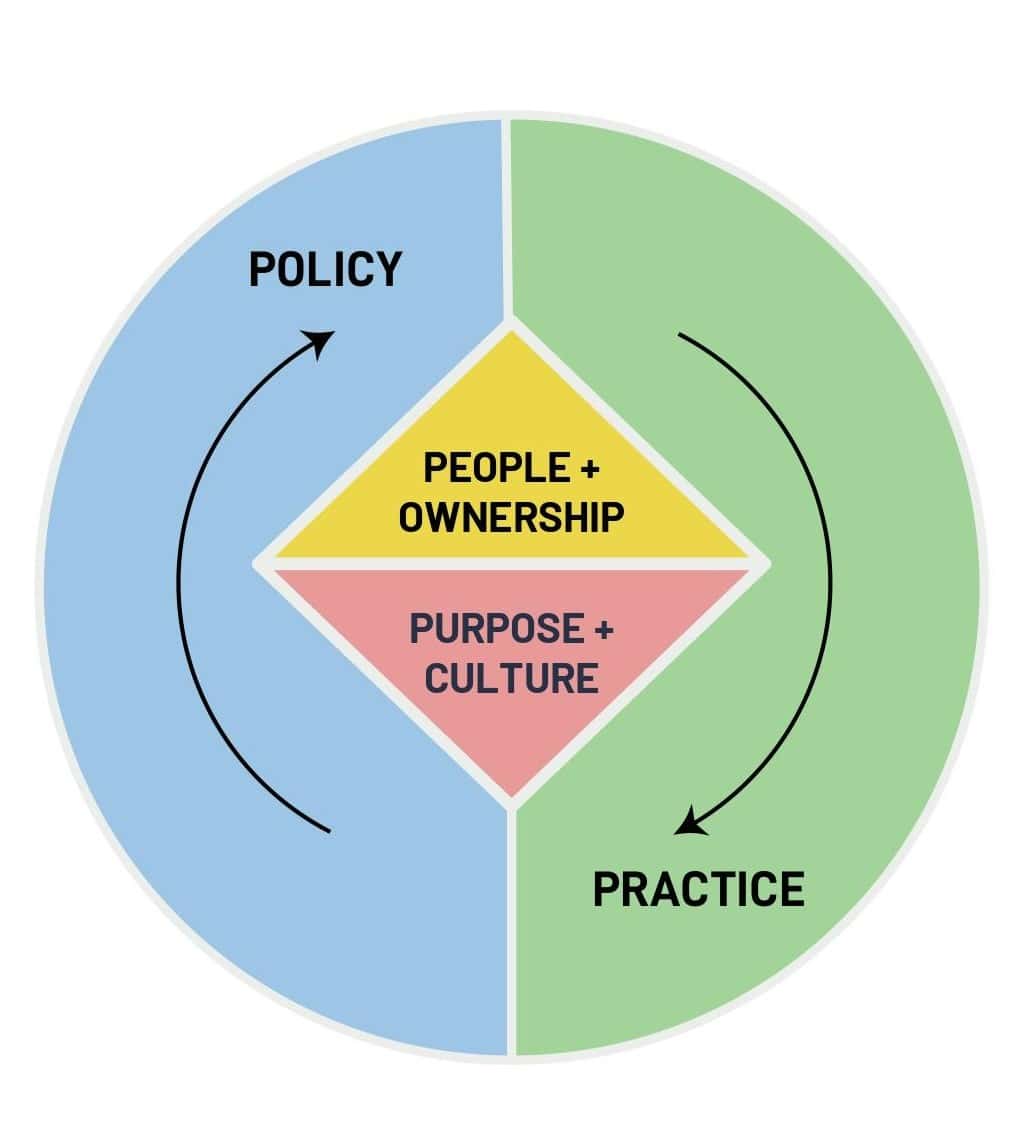

Lucid Capitalism’s basic framework provides a helpful way to think about how governance works in practice. There are four major building blocks: people, purpose, policy, and practice.

Prepared by Lucid Capitalism

-

-

- People + Ownership: The board and leadership set the tone for company culture. They create and enforce governance mechanisms.

- Purpose + Culture: An articulated purpose aligns the board, management, and employee interests, ensuring that day-to-day actions are in line with long-term goals.

- Policy: Enforced by leadership, policies are mechanisms to ensure compliance and institutionalize culture.

- Practice: Leadership should demonstrate policy enforcement and decision-making that aligns with the company’s purpose, creating a virtuous cycle of good governance.

-

Examples of Good and Bad Governance

Shu Dar shared a few examples to demonstrate how the governance framework described above functions in practice:

Stripe is a good example of governance – With a mission to “increase the GDP of the internet,” this provider of online payment products has grown from zero to a valuation of more than $70B in a decade.

-

-

- Day-to-day decisions are guided by a documented guide to operating principles.

- Visionary long-term thinking and a consistent focus on the mission inform decision-making.

- Management communicates the importance of the team’s work to achieving company goals.

- Employees are encouraged to speak up and contribute; management conducts frequent employee satisfaction surveys.

-

Opsware is another example of good governance, even in a tough situation – A pioneer in SaaS and cloud computing, the company underwent three rounds of layoffs before eventually being sold to HP in 2007. Even today, the actions of then-CEO and co-founder Ben Horowitz (co-founder of a16z) are recognized as exemplary of the best way to conduct a reduction in force.

-

-

- Avoided destroying culture by being transparent, timely, intentional, and human with employees.

- Leaned on the board and investors to navigate the right next steps.

- Invested time and support into management to deliver difficult news to their teams.

-

WeWork is an example of poor governance – This provider of shared office space withdrew a highly anticipated IPO after criticism of its corporate governance.

-

-

- Limited controls: Unbalanced shareholder power and absence of board oversight. CEO had 20:1 voting rights.

- Company culture failed to foster diversity.

- Lack of alignment on long-term vision among leadership.

- High valuations despite a short-sighted business model.

- Self-dealing: Founder-owned trademarks, received $5-9 million from the company to license them.

-

How Does Governance Affect Long-Term Success?

Although it occurred many years ago, the Opsware example is still relevant, because many companies, both public and private, may be entering (or are already in) a challenging period in today’s economic climate. Although it is something no one ever wants to do, you one day may have to think about a workforce reduction. And when that is the case, make sure you take care of your people, ensure they know as much about what’s happening as you can share, and don’t lose track of your culture and purpose.

In tough times, the first priority is to survive and maintain viability. After that, continued performance will build resilience. And, if you capitalize on growth opportunities, you can increase vitality and thrive. At each of these stages, governance can play a critical role by:

-

-

- Maintaining focus on the vision, mission, and core values

- Engaging all stakeholders (employees, board, etc.) to maximize their contributions

- Helping to base short-term decisions on long-term strategy

-

Five Common Pain Points

Before the webinar, we had multiple conversations with founders and leaders of Norwest portfolio companies to learn what governance issues were top of mind for them. Here were the top five issues, and our perspective on them.

1. Workforce Rightsizing

How you treat your team, your staff, and your suppliers during tough times will be remembered. If and when rightsizing becomes an issue for you, be as thoughtful and rigorous and humane as possible. It’s important to remember that people and the role they play in building and upholding company culture are central to good governance, and a poorly conducted downsizing can make ongoing operations challenging.

2. Share Structures, Voting Rights, and Equity Valuation

Everyone recognizes that we are in a very different environment today than we were a year ago, which raises challenges regarding equity-based compensation. (A recent Norwest blog explored best practices for designing the optimum retention equity program.)

We want to emphasize that employee morale is a very important consideration when you look at adjusting options. At the same time, you need to consider the shifting dynamics of your investors. As much as possible, be intentional with all your stakeholders about what the future of your company looks like. Transparency is always the best policy, even if you can’t be transparent about everything.

3. Documentation and Compliance

It may seem obvious, but complete, accurate, and secure record-keeping is essential to any business. We’re talking about a central repository for:

-

-

-

- Financial statements

- Employee records

- Board and stockholder minutes

- Stock and options ledger

- Tax filings and records

- Secretary of state filings

-

-

You are going to need one person (with job security) to make sure all these records are kept in order, and that you have one shared calendar of record-keeping requirements for the entire C suite. Designating this person from the start—even if it is secondary to their primary job—is a wise decision, and if you don’t have this person yet, it’s never too late to appoint someone.

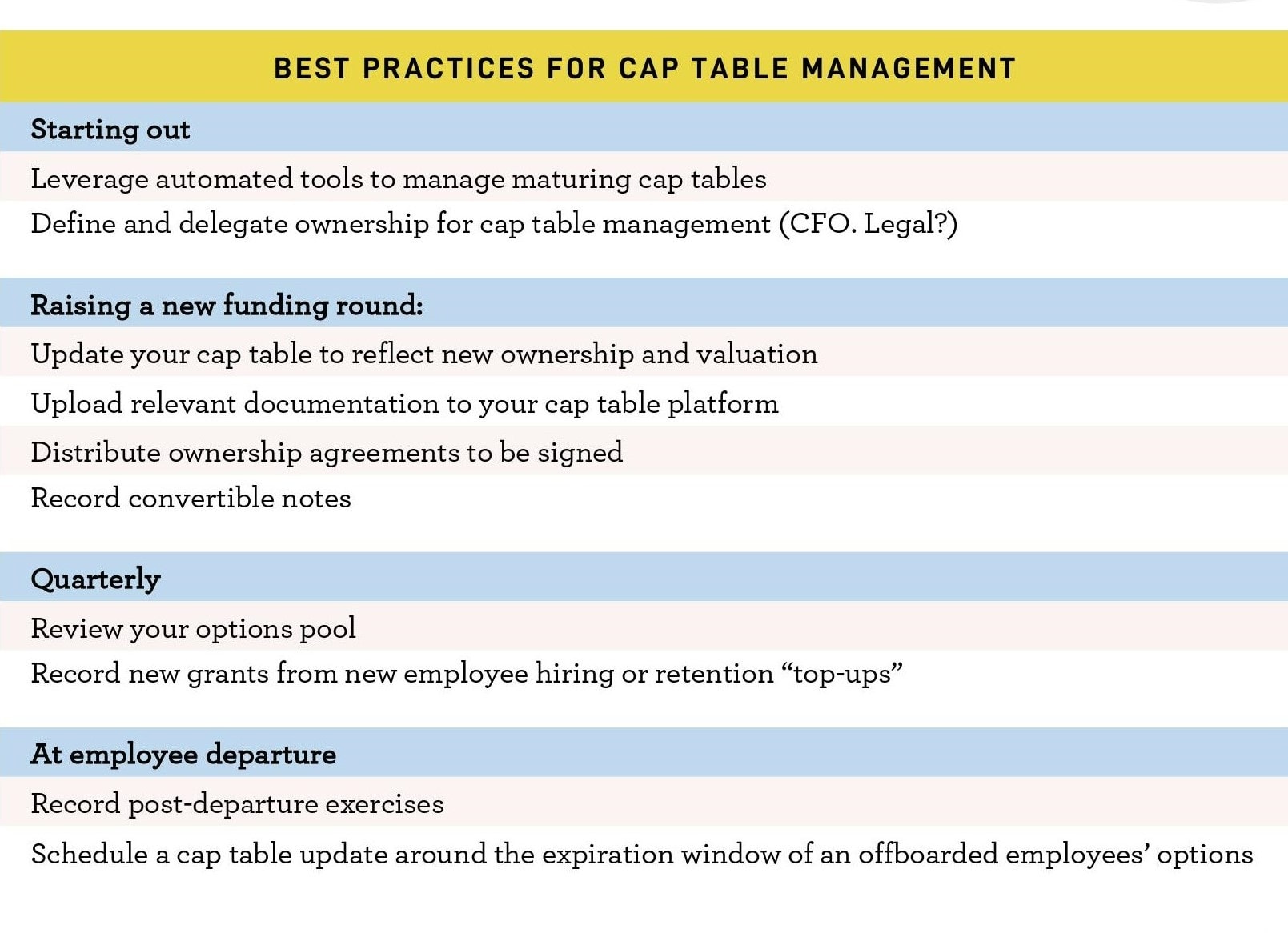

4. Cap Table Management

We’re surprised by the number of times someone has said to us, “my cap table started off so simple, but got complex really quickly.” It is important to keep your cap table clean and up to date, as it’s the first view of your ownership structure that investors are going to see and that first impression counts. Nobody wants a messy sheet to parse through.

Here’s a summary of how you can maintain your cap table:

Prepared by Lucid Capitalism

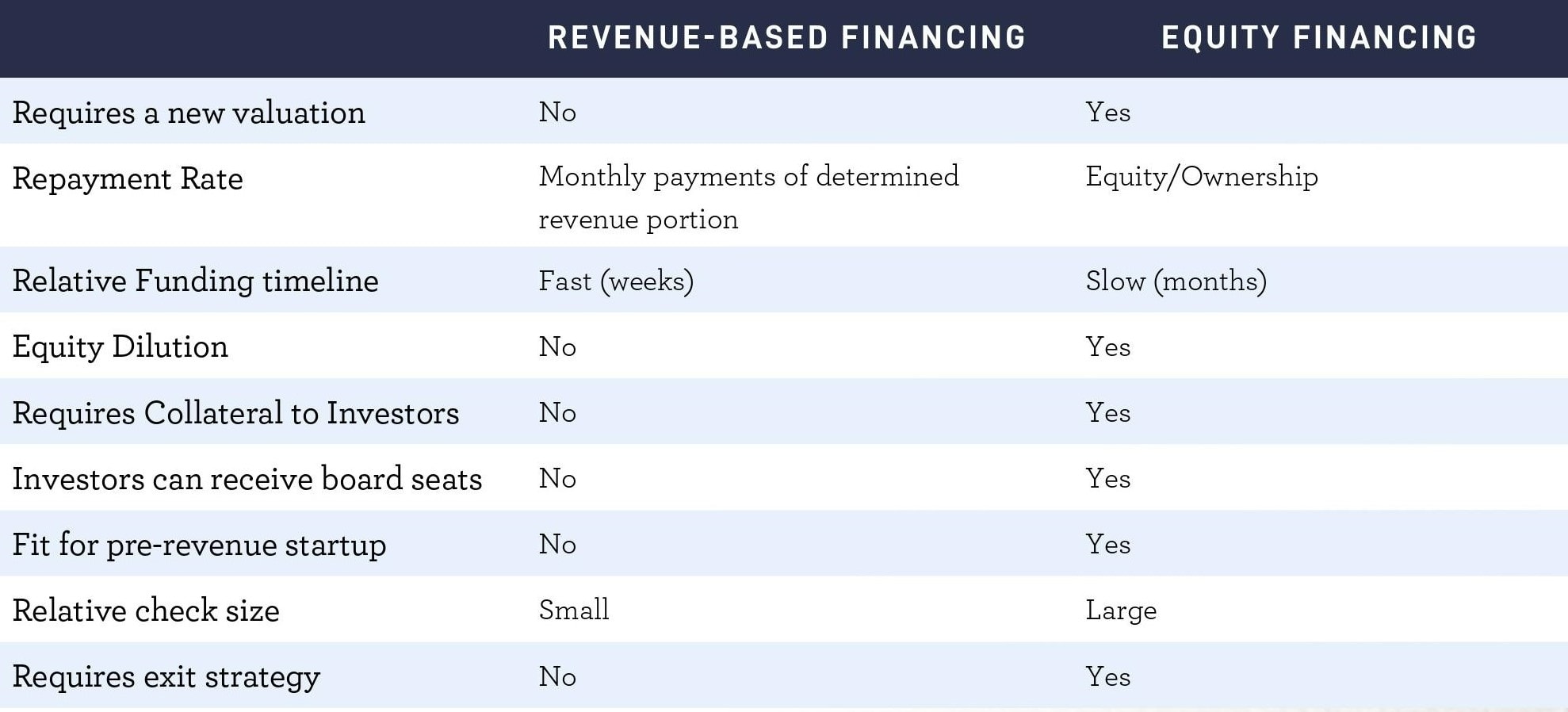

5. Revenue-Based Financing

Now might be a good time to think about what you want from your capital structure over the next three to five years, especially if your team has a strong CFO and if you are not too worried about current market conditions. For example, do you want a bit more debt in your cap table? One option might be revenue-based financing, in which investors provide capital in exchange for a percentage of the company’s ongoing revenues. This might be attractive, say, for a SaaS company with strong recurring revenues. It could give you a bit more power to share equity with your employees.

This chart summarizes some of the differences between revenue-based and equity-based financing.

Prepared by Lucid Capitalism

Final thoughts

Silicon Valley is littered with businesses that have yet to break even because they didn’t take actions to ensure the sustainability of their business. That’s why we devoted this webinar to governance and the critical roles people and culture play in making a company successful.

What the general partners of VC funds think about first and foremost is governance. “Is this an organization I trust? Do they have the track record? Have they demonstrated high integrity through multiple downturns, and are thus better able to make it through a choppy market?”

We leave you with two driving ideas:

-

-

- Your future success will depend in part on how you handle present challenges.

- Governing responsibly and treating your people right will foster resilience.

-

Lisa Ames is Norwest’s CMO and Operating Executive. She leverages her more than 20 years of B2B SaaS marketing experience working shoulder-to-shoulder with portfolio companies to help them thrive.